Special mention

Posts Tagged ‘Bernanke’

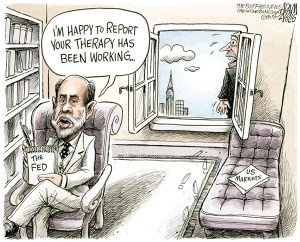

Cartoon of the day

Posted: 21 September 2013 in UncategorizedTags: banks, Bernanke, budget, cartoon, debt, economy, Federal Reserve, JPMorganChase, Republicans, SEC

0

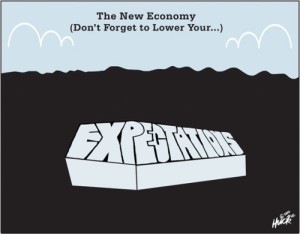

Cartoon of the day

Posted: 17 August 2013 in UncategorizedTags: Bernanke, cartoon, debt, economy, education, expectations, Federal Reserve, recovery, stimulus, students

Cartoon of the day

Posted: 6 July 2013 in UncategorizedTags: banks, Bernanke, cartoon, debt, money, students, vacation, Wall Street, workers

Cartoon of the day

Posted: 3 July 2013 in UncategorizedTags: apparel, Bangladesh, Bernanke, cartoon, debt, jobs, monetary policy, students, trade, Wall Street, workers

Cartoon of the day

Posted: 30 June 2013 in UncategorizedTags: banks, Bernanke, cartoon, corporations, Federal Reserve, jobs, stock market, wages, workers

Cartoon of the day

Posted: 26 June 2013 in UncategorizedTags: Bernanke, cartoon, crisis, race, Second Great Depression, Supreme Court, United States, voting

Economist of the day

Posted: 13 April 2013 in UncategorizedTags: Bernanke, Economist, Federal Reserve, humor, money

What began as a routine report before the Senate Finance Committee Tuesday ended with [Federal Reserve chairman Ben] Bernanke passionately disavowing the entire concept of currency, and negating in an instant the very foundation of the world’s largest economy.

“Though raising interest rates is unlikely at the moment, the Fed will of course act appropriately if we…if we…” said Bernanke, who then paused for a moment, looked down at his prepared statement, and shook his head in utter disbelief. “You know what? It doesn’t matter. None of this—this so-called ‘money’—really matters at all.”

“It’s just an illusion,” a wide-eyed Bernanke added as he removed bills from his wallet and slowly spread them out before him. “Just look at it: Meaningless pieces of paper with numbers printed on them. Worthless.”

According to witnesses, Finance Committee members sat in thunderstruck silence for several moments until Sen. Orrin Hatch (R-UT) finally shouted out, “Oh my God, he’s right. It’s all a mirage. All of it—the money, our whole economy—it’s all a lie!”

Cartoon of the day

Posted: 22 March 2013 in UncategorizedTags: banks, Bernanke, cartoon, Cyprus, money, productivity, profits, stock market, Wall Street

Hiding their heads in the sand

Posted: 19 January 2013 in UncategorizedTags: 1929, 2007, Bernanke, Federal Reserve, Great Depression, Second Great Depression, United States

We now know, thanks to the release of the minutes of the 7 August 2007 meeting of the Federal Open Market Committee, that those in attendance were acting like ostriches: foolishly ignoring the mounting economic problems, while hoping they would magically vanish.

Here, for example, is William Poole, president of the Federal Reserve Bank of St. Louis:

My own bet is that the financial market upset is not going to change fundamentally what’s going on in the real economy. First of all, bank capital is not impaired. So unlike in some past cases, when losses on real estate impaired bank capital and thus affected the lending in areas that had nothing to do with real estate, I don’t think that’s the case this time. Second, the fact that some LBO deals fall through isn’t going to change what those companies are producing. The fact that the ownership hasn’t changed doesn’t change the company’s profit-maximizing level of production in the short run. Obviously, that could change, but it seems to me that the best information that we now have is that this financial market upset is going to settle out and not have major repercussions on the real economy, putting the housing part aside. Thank you. (p. 57)

As it turns out, the Board of Governors of the Fed performed a similar ostrich-like move back in February 1929.* As you can see from the extracts pasted below, Adolph C. Miller was clearly aware of increased speculation in the stock market (a month before the crash in March) but he and a majority of the other members of the board chose not to make a public statement.

Apparently, the officials in charge of the Federal Reserve acted—in 2007 as in 1929—like ostriches with their heads in the sand, hoping the accumulating stresses and strains in the economy would magically vanish.

And, of course, they didn’t—leaving us in both cases on the road to a great depression.

*The minutes of the 2 February meeting are available as a pdf file here.

Wall Street hold ‘em

Posted: 25 November 2012 in UncategorizedTags: art, Bernanke, cards, crisis, games, Wall Street

The series continues with the King of Diamonds: Ben Bernanke.

Repeatedly asserted that subprime was contained.