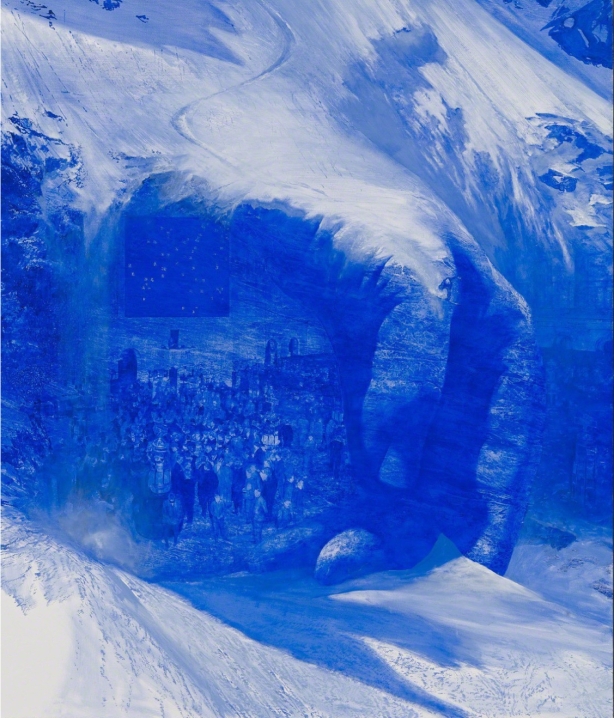

Mark Tansey, “Invisible Hand” (2011)

Yesterday, I explained that the 2016 Nobel Prize in Economics Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel was awarded to Oliver Hart and Bengt Holmstrom because, through their neoclassical version of contract theory, they “proved” that capitalist firms—employers hiring labor to produce commodities in privately owned corporations—were the most natural, efficient way of organizing production.

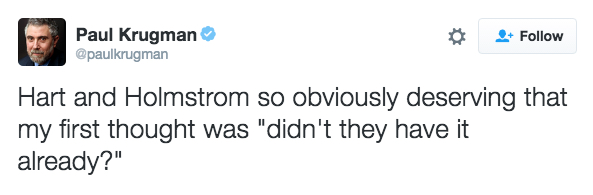

It should come as no surprise, then, that mainstream economists—initially in tweets, then in full blog posts—have heaped praise on this year’s award.

Paul Krugman couldn’t believe Hart and Holmstrom hadn’t won the prize already, while Justin Wolfers considered them “an unarguably splendid pick.”

Tyler Cowen also expressed his conviction that the new Nobel laureates are “well-deserving economists at the top of the field.” (He then explains, in separate posts, the significance for neoclassical theory of Hart’s and Holmstrom’s research on the theory of the firm.) The other member of the Marginal Revolution team, Alex Tabarrock, follows up by criticizing the one instance in Hart’s work in which he actually criticizes private enterprise. Hart (in a piece with two other economists) argues one of the downsides of private prisons is that they sacrifice quality for cost—but, according to Tabarrock, “private prisons appear to be cheaper than public prisons but they are not significantly cheaper and the quality of private prisons is comparable to that of public prisons and maybe a little bit higher.”

And then there’s Noah Smith, who follows suit by praising “the new exciting tools that have been developed in the micro world,” including by the new Nobel laureates. He refers to that work in microeconomics as the “real engineering”—as against macroeconomics, “whose scientific value is still being debated.”

The fact is, the value of both areas of mainstream economics is still being debated, as it has been from the very beginning. There is nothing settled (except, perhaps, in the minds of mainstream economists) about either the theory of the firm or the causes of recessions and depressions, the determinants of a commodity’s value or the prospects for long-term capitalist growth, whether the labor market or the economy as a whole is in any kind of equilibrium.

Smith overlooks or ignores those debates, most of which occur between mainstream economists and other, nonmainstream heterodox economists. But then, in attempting to explain why this year’s prize went to microeconomists, Smith displays his real misunderstanding of the history of economics—arguing that “macro developed first.”

Economists saw big, important phenomena like growth, recessions and poverty happening around them, and they wrote down simple theories to explain what they saw. The theories started out literary, and became more mathematical and formal as time went on. But they had a few big things in common. They assumed the people and the companies in the economy were each very tiny and insignificant, like particles in a chemical solution. And they typically assumed that everyone follows very simple rules — companies maximize profits, consumers maximize the utility they get from consuming things. Pour all of these tiny simple companies and people into a test tube called “the market,” shake them up, and poof — an economy pops out.

Here’s the problem: macroeconomics didn’t develop first. Indeed, it wasn’t invented until the 1930s, when John Maynard Keynes published The General Theory of Employment, Interest, and Money. This should not be surprising, given the fact that the world was in the midst of the Great Depression, with at least 25 percent unemployment, after neoclassical microeconomists (following their classical predecessors, Adam Smith, David Ricardo, and Jean-Baptiste Say) had attempted to prove that markets would always be in equilibrium, which of course ruled out economic depressions and massive unemployment. Oops!

Since then, we’ve seen a mainstream tradition that combines (in different, shifting ways) neoclassical microeconomics and Keynesian macroeconomics—a tradition that failed miserably both in the lead-up to and following on the second Great Depression.

But no matter, at least from the perspective of mainstream economics, because its leading practitioners—sometimes from the macro side, this year from the micro side—continue, as if by contract, to be awarded Nobel prizes.

The thing with Noah Smith is not just — or even mainly — that he is a self-appointed cheerleader for mainstream economics.

I think there’s another problem. It seems reasonable to give him the benefit of the doubt and assume he does know what he studied. Given that premise, this second problem is that, as a physicist who did a PhD in mainstream macroeconomics/finance, that’s at best his expertise.

In other words, he basically shouldn’t write about anything, but those subjects. But now he is a professional columnist, who needs to write about all sorts of things for which he has no expertise whatsoever.

———-

Personally, I doubt he knows much even about mainstream microeconomics (which I bet was an afterthought during his time as a graduate student), much less about the history of economic thought.

That doesn’t bode well, for a professional columnist. I think his career move (from teaching finance to columnist) was hasty.

You’re right, Magpie. It’s actually something I and many others have argued over the years: mainstream economists (at least some of them) know a lot about a little corner of mainstream economics (and then there are many others who know even less). Those of us who are not mainstream economists are forced to have the freedom to know a lot about both mainstream and heterodox economic theories. It just comes with the territory.

I’m afraid I’m just an econo-aficionado.

Reblogged this on Radical Political Economy.

The shake it up in a test tube metaphor is rubbish, and the profit-max/ utility max idea is anachronistic, since that is more properly neoclassical than classical. But I think Noah may be on to something when he says the early political economists were interested in big questions. Adam Smith was about “the big picture”, how economies grew and developed through the division of labor. As Baumol put it, the “magnificent dynamics of classical political economy. Before him the Physiocrats were coming up with a sort of cross between input-output and circular flow of income. Malthus was a vigorous opponent of Ricardo’s view that gluts were impossible. Indeed Keynes himself talks of this

Macro was not born with Keynes, that is too narrow a view.