Special mention

Posts Tagged ‘invisible hand’

Cartoon of the day

Posted: 1 April 2020 in UncategorizedTags: bailout, cartoon, coronavirus, corporations, health insurance, inequality, invisible hand, pandemic, poor, rich, Trump

0

Cartoon of the day

Posted: 18 March 2020 in UncategorizedTags: cartoon, coronavirus, healthcare, invisible hand, Medicare for All, recession, stock market

Myth of “the market”

Posted: 24 July 2017 in UncategorizedTags: CEOs, critique, economics, inequality, invisible hand, mainstream, market, markets, neoclassical, workers

We’ve all heard it at one time or another.

Why is the price of gasoline so high? Mainstream economists respond, “it’s the market.” Or if you think you deserve a pay raise, the answer again is, “go get another offer and we’ll see if you’re worth it according to ‘the market’.”

And then there’s CEO pay, which last year was 271 times the average pay of workers. Ah, it’s what “the market” has determined the appropriate compensation to be.

“The market” explains everything—and, of course nothing.

Chris Dillow argues that invoking “the market” (e.g., to explain the gender disparities in pay for BBC broadcasters) serves to hide from view the role of power.

Talk of the “market” is therefore what Georg Lukacs called reification – the process whereby “a relation between people takes on the character of a thing and thus acquires a ‘phantom objectivity.’” It obfuscates the fact that wages are set by the power of one person over another. Such obfuscation serves a profoundly ideological function; it effaces the fact that the capitalist economy is based upon power relationships.

Not even neoclassical economists stop with references to the “the market.” That’s just the first step of the explanation. The next step is to analyze “the market” in terms of its ultimate—given or exogenous—factors determining supply and demand. Their story is that “the market” can finally be reduced to and explained by preferences, resource endowments, and technology. In other words, according to neoclassical economists, market prices—whether for gasoline, workers’ pay, and CEO compensation—reflect consumer preferences, households’ endowments, and human know-how, all of which are considered to be prior to and independent of the economy.

That’s the way formal neoclassical economics works. But mainstream economists are also content to let the myth of “the market” persist in the minds of their students and the proverbial person in the street because it protects markets from what they consider to be unwarranted regulation and intervention. “The market” is turned into an abstract entity that merely reflects human nature. And if anyone wants to change the results—to change, for example, the price of gasoline, workers’ wages, or CEO compensation—they face the daunting task of changing human nature.

But there’s another side to the myth of “the market.” It becomes symbolic of an entire system gone awry—and which therefore can be criticized and replaced.

Instead of “the market,” we might refer to individual markets—not just to markets for gasoline, workers’ ability to labor, or CEOs’ skills but to markets for different kinds of gasoline, different groups of workers, or CEOs in different industries. Or, alternatively, we might invoke the different roles producers, consumers, workers, corporate executives, government officials, and so on play in determining market outcomes. All of those individual markets and market participants might then be regulated to produce different outcomes.

But if it’s “the market” that is to blame, then it’s the entire system—not one or another market or market participant—that needs to be radically transformed.

If mainstream economists defend and celebrate “the market,” critics of market outcomes—of which there are many—can then move to a more systemic assessment, to become critics of the economy as a whole.

And once that happens, critics can then imagine and begin to create a different economic system, one that is not governed by “the market.” Such an alternative system might have markets, lots of different kinds of markets. But it would have a different logic, a different way of operating, with very different outcomes.

Such an alternative economy exists on the other side, beyond the myth of “the market.”

Cartoon of the day

Posted: 13 July 2017 in UncategorizedTags: cartoon, climate change, economy, environment, free market, invisible hand, markets, Obamacare, Republicans, rich, tax cuts, Trumpcare

Contract this!

Posted: 12 October 2016 in UncategorizedTags: classical, economics, invisible hand, Keynes, mainstream, microeconomics, neoclassical, Nobel Prize

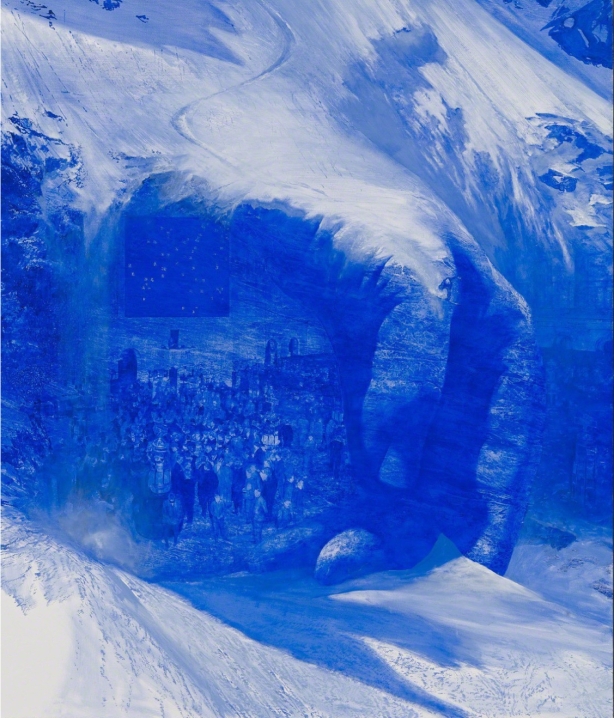

Mark Tansey, “Invisible Hand” (2011)

Yesterday, I explained that the 2016 Nobel Prize in Economics Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel was awarded to Oliver Hart and Bengt Holmstrom because, through their neoclassical version of contract theory, they “proved” that capitalist firms—employers hiring labor to produce commodities in privately owned corporations—were the most natural, efficient way of organizing production.

It should come as no surprise, then, that mainstream economists—initially in tweets, then in full blog posts—have heaped praise on this year’s award.

Paul Krugman couldn’t believe Hart and Holmstrom hadn’t won the prize already, while Justin Wolfers considered them “an unarguably splendid pick.”

Tyler Cowen also expressed his conviction that the new Nobel laureates are “well-deserving economists at the top of the field.” (He then explains, in separate posts, the significance for neoclassical theory of Hart’s and Holmstrom’s research on the theory of the firm.) The other member of the Marginal Revolution team, Alex Tabarrock, follows up by criticizing the one instance in Hart’s work in which he actually criticizes private enterprise. Hart (in a piece with two other economists) argues one of the downsides of private prisons is that they sacrifice quality for cost—but, according to Tabarrock, “private prisons appear to be cheaper than public prisons but they are not significantly cheaper and the quality of private prisons is comparable to that of public prisons and maybe a little bit higher.”

And then there’s Noah Smith, who follows suit by praising “the new exciting tools that have been developed in the micro world,” including by the new Nobel laureates. He refers to that work in microeconomics as the “real engineering”—as against macroeconomics, “whose scientific value is still being debated.”

The fact is, the value of both areas of mainstream economics is still being debated, as it has been from the very beginning. There is nothing settled (except, perhaps, in the minds of mainstream economists) about either the theory of the firm or the causes of recessions and depressions, the determinants of a commodity’s value or the prospects for long-term capitalist growth, whether the labor market or the economy as a whole is in any kind of equilibrium.

Smith overlooks or ignores those debates, most of which occur between mainstream economists and other, nonmainstream heterodox economists. But then, in attempting to explain why this year’s prize went to microeconomists, Smith displays his real misunderstanding of the history of economics—arguing that “macro developed first.”

Economists saw big, important phenomena like growth, recessions and poverty happening around them, and they wrote down simple theories to explain what they saw. The theories started out literary, and became more mathematical and formal as time went on. But they had a few big things in common. They assumed the people and the companies in the economy were each very tiny and insignificant, like particles in a chemical solution. And they typically assumed that everyone follows very simple rules — companies maximize profits, consumers maximize the utility they get from consuming things. Pour all of these tiny simple companies and people into a test tube called “the market,” shake them up, and poof — an economy pops out.

Here’s the problem: macroeconomics didn’t develop first. Indeed, it wasn’t invented until the 1930s, when John Maynard Keynes published The General Theory of Employment, Interest, and Money. This should not be surprising, given the fact that the world was in the midst of the Great Depression, with at least 25 percent unemployment, after neoclassical microeconomists (following their classical predecessors, Adam Smith, David Ricardo, and Jean-Baptiste Say) had attempted to prove that markets would always be in equilibrium, which of course ruled out economic depressions and massive unemployment. Oops!

Since then, we’ve seen a mainstream tradition that combines (in different, shifting ways) neoclassical microeconomics and Keynesian macroeconomics—a tradition that failed miserably both in the lead-up to and following on the second Great Depression.

But no matter, at least from the perspective of mainstream economics, because its leading practitioners—sometimes from the macro side, this year from the micro side—continue, as if by contract, to be awarded Nobel prizes.

Automation and the invisible hand

Posted: 19 August 2016 in UncategorizedTags: automation, blue-collar, invisible hand, robots, technology, white collar, workers

We all know that some large portion of workers and their jobs are threatened—now and in the future—by new technologies. That’s why I’ve been increasingly writing about the conditions and consequences of robots and automation.

According to McKinsey, “currently demonstrated technologies could automate 45 percent of the activities people are paid to perform and that about 60 percent of all occupations could see 30 percent or more of their constituent activities automated, again with technologies available today.” In their view, it’s not so much that whole occupations will be eliminated in the foreseeable future, but that automation will affect a great many jobs and activities within those jobs.

It means, under existing economic arrangements, automation will occur where it is technically feasible and financially profitable—and, where it does occur, workers will increasingly become appendages of machines.

The prime candidate for automation is what the authors of the report refer to as “predictable physical work,” that is, performing physical activities or operating machinery in a predictable environment. This includes many manufacturing activities but, as it turns out, it’s also true in the service sector. In fact, according to McKinsey, the most readily automatable sector in the U.S. economy is “accommodations and food service.”

But that’s only on technical grounds. Since the prevailing wage in that sector is very low, many of the workers’ activities may not in fact be automated based on cost considerations. In that case, it’s the threat of automation that will most affect workers and their jobs.

But there are many other activities and sectors that might be automated with the existing technologies (including software). These include manufacturing (where “performing physical activities or operating machinery in a predictable environment represents one-third of the workers’ overall time”), retailing (including “packaging objects for shipping and stocking merchandise” as well as “maintaining records of sales, gathering customer or product information, and other data-collection activities”), financial service and insurance (in which “50 percent of the overall time of the workforce. . .is devoted to collecting and processing data, where the technical potential for automation is high”), and so on.

And the two with the lowest technical feasibility for automation? Healthcare and education. But, even in those sectors, a large number of activities is susceptible to being automated—from food preparation to data collection—at least on technical grounds.

So, what’s going to happen with workers and their jobs as automation moves forward (and as new technologies, such as machine learning, are imagined and devised)?

From what we know about the past, the actual history of technology and capitalism, new forms of automaton will be invented and made technically feasible where their production is financially profitable, and they will become profitable when it’s possible for one enterprise to use automation to outcompete other enterprises (based on a wide range of factors, from lowering production costs to improving the quality of output) in order to secure higher profits.

And, as in the past, the effects on workers will simply be ignored by their employers. Some of their employees will lose their jobs (as they are replaced by robots and digital technologies); for others, their jobs will be fundamentally transformed (e.g., as their work is surveilled by machines and as they become appendages of the automated processes and technologies). Blue-collar workers already know this. White-collar workers are quickly discovering how and why it might happen to them. In both cases, a changing combination of actual automation and the threat of automation is making their work and their livelihoods less and less secure.

But, according to Steven Pearlstein, workers have no need to worry. The invisible hand will take care of them.

The winners from job-destroying technology hire more gardeners, housekeepers and day-care workers. They take more vacations and eat at more restaurants. They buy more cars and boats and bigger houses. They engage the services of more auto mechanics and personal trainers, psychologists and orthopedic surgeons.

Sure, Pearlstein admits, it may take “years, even decades” for the necessary adjustments to occur. But “People who lose their jobs must have the willingness and wherewithal to find new opportunities, learn new skills, move to new cities.”

Whether or not workers take it upon themselves to adjust to the “creative destruction” Pearlstein and mainstream economists celebrate, it is still the case that the decisions about automation will be taken by their employers, not workers themselves. And the benefits, as always, will be appropriated by the small group at the top, not the mass of employees at the bottom.

Perhaps the only hope for workers—until they are able to change the existing economic institutions—is to imagine a process whereby the tasks their employers currently assign to themselves and their managers will become automated. As a result, those who direct the enterprises will also become superfluous.

Pie in the sky, perhaps. But it’s an invisible hand no less utopian than the one Pearlstein and mainstream economists currently believe in.

The invisible hand

Posted: 21 July 2016 in UncategorizedTags: Adam Smith, art, economic representations, economists, fiction, Hans Haacke, invisible hand, mainstream, neoclassical

Hans Haacke, “The Invisible Hand of the Market” (2009)

Mainstream economists have attempted to model and disseminate the idea of the invisible hand, especially in their textbooks.*

And, not surprisingly, many others—from heterodox economists to artists—have challenged the whole notion of the invisible hand.

But one of the best critiques of the invisible hand I have encountered can be found in Kim Stanley Robinson’s story, “Mutt and Jeff Push the Button” (which appears in Fredric Jameson’s recent book, An American Utopia: Dual Power and the Universal Army).

Here’s a longish extract:

“So, we live in a money economy where everything is grossly underpriced, except for rich people’s compensation, but that’s not the main problem. The main problem is we’ve agreed to let the market set prices.”

“The invisible hand.”

“Right. Sellers offer goods and services, buyers buy them, and in the flux of supply and demand the price gets determined. That’s the cumulative equilibrium, and its prices change as supply and demand change. It’s crowdsourced, it’s democratic, it’s the market.”

“The only way.”

“Right. But it’s always, always wrong. Its prices are always too low, and so the world is fucked. We’re in a mass extinction event, the climate is cooked, there’s a food panic, everything you’re not reading in the news.”

“All because of the market.”

“Exactly. It’s not just there are market failures. It’s the market is a failure.”

“How so, what do you mean?”

“I mean the cumulative equilibrium underprices everything. Things and services are sold for less than it costs to make them.”

“That sounds like the road to bankruptcy.”

“It is, and lots of businesses do go bankrupt. But the ones that don’t haven’t actually made a profit, they’ve just gotten away with selling their thing for less than it cost to make it. They do that by hiding or ignoring some of the costs of making it. That’s what everyone does, because they’re under the huge pressure of market competition. They can’t be undersold or they’ll go out of business, because every buyer buys the cheapest version of whatever. So the sellers have to shove some of their production costs off their books. They can pay their labor less, of course. They’ve done that, so labor is one cost they don’t pay. That’s why we’re broke. Then raw materials, they hide the costs of obtaining them, also the costs of turning them into stuff. Then they don’t pay for the infrastructure they use to get their stuff to market, and they don’t pay for the wastes they dump in the air and water and ground. Finally they put a price on their good or service that’s about 10 percent of what it really cost to make, and buyers buy it at that price. The seller shows a profit, shareholder value goes up, the executives take their bonuses and leave to do it again somewhere else, or retire to their mansion island. Meanwhile the biosphere and the workers who made the stuff, also all the generations to come, they take the hidden costs right in the teeth.”

*As I have discussed before, the invisible hand is a powerful metaphor “for which neoclassical economists have worked very hard to invent a tradition beginning with Adam Smith.” Smith himself only used the term twice in his published writings—once in The Theory of Moral Sentiments and again in The Wealth of Nations—and never to refer to a self-equilibrating market system, which is the way the term is used by mainstream economists today.

Elite divisions?

Posted: 12 July 2016 in UncategorizedTags: capitalism, conservative, economics, economists, elites, free markets, invisible hand, liberal, mainstream

As if in direct response to one of my recent posts on “ignoring the experts,” the best mainstream economist Noah Smith can come up with is there is no single, unified elite opinion—perhaps on Brexit but not on most economic issues.

The “elite” isn’t a single unified bloc. There are many different kinds of elites. Politicians, bureaucrats, wealthy businesspeople, corporate managers, financiers, academics and media personalities can all be labeled elites. But there are huge fissures and rivalries both within and between these groups. They are almost never in broad agreement on any issue — Brexit was the exception, not the rule.

That’s not saying much. Of course, elites and elite opinions are divided. They have always have been and certainly are now.

The issue is not whether different groups or fractions within the elite hold different opinions, but the limits of those differences and the views that are marginalized or excluded as a result.

Consider the views of mainstream economists (which is really what my original post was about). They hold different views about most economic issues—from labor markets to international trade—but the range of differences is very narrow. As I explained back in January:

while conservative mainstream economists believe that efficiency, growth, and full employment stem from allowing markets to operate freely, liberal mainstream economists argue that markets are often imperfect and therefore the only way to achieve (or at least approximate) those goals is to intervene in and regulate markets. Those are the terms of the mainstream debate in economics, from the origins of modern economic discourse in the late-eighteenth century right on down to the present.

Think about it as the difference between the invisible hand and the visible hand.

Liberal mainstream economists, of course, hotly contest the free-market doctrine of their conservative counterparts. But notice also that they hold in common both the goals and the limits of economic policy with conservatives. Liberals and conservatives share the idea that the goals of an economy are to ensure efficiency, growth, and full employment. And they share the idea that economic policy should be limited to tinkering with capitalism—in the direction of more regulation or, for conservatives, more free markets—in order to achieve those goals.

That’s it, the limits of the mainstream debate.

Mainstream economists use different theories and promote different policies within those narrow limits. What they exclude are theories and policies that fall outside those limits—and thus, in their view, don’t deserve a hearing.

Their expertise ends when it comes to theories that focus on such things as the inherent instability of capitalism or the role of class in determining the value of goods and services and the distribution of income. And they exclude policies that either change the fundamental rules of capitalism or look beyond capitalism, to alternative ways of organizing economic and social life.

What that means, concretely, is mainstream economists tend to minimize the damage—to different groups of people and to society as a whole—of existing economic arrangements. Just as Paul Krugman minimizes the loss of jobs from deindustrialization (“we’re talking about 1.5 percent of the work force”), Smith understates the disruptive effects of globalization (in referring to “some economic setbacks” for the middle-class of rich nations while presuming everyone else has gained).

So, yes, mainstream economists (like the elites whose position they never contest) often find themselves disagreeing among themselves about theories and policies. But it’s precisely because the limits of their disagreements are so narrow, there’s always a surplus of meaning that falls outside of and escapes their purview. That’s when alternative theories and policies flourish—and all mainstream economists can do is invoke their self-professed expertise to attempt to quash the alternatives and relegate them to (or beyond) the margins.

Sometimes, of course, it works and non-elite opinion falls in line. But other times—after the crash of 2007-08, in the lead-up to the Brexit vote, and so on—it doesn’t and the narrow limits of expert opinion are challenged, parodied, or ignored. And other possibilities, always just below the surface, acquire new resonance.

Elites, who simply can’t or don’t want to understand, suggest the masses just eat cake (or, today, crack)—and, like Smith, hide behind the idea that “there are no easy answers to the challenges of the modern global economy.”