Tim Harford offers a short but useful piece on the medieval origins of modern banking—in the Knights Templar, the great fair of Lyon, and so on.*

The Templars dedicated themselves to the defence of Christian pilgrims to Jerusalem. The city had been captured by the first crusade in 1099 and pilgrims began to stream in, travelling thousands of miles across Europe.

Those pilgrims needed to somehow fund months of food and transport and accommodation, yet avoid carrying huge sums of cash around, because that would have made them a target for robbers.

Fortunately, the Templars had that covered. A pilgrim could leave his cash at Temple Church in London, and withdraw it in Jerusalem. Instead of carrying money, he would carry a letter of credit. The Knights Templar were the Western Union of the crusades.

But, with the loss of control over of Jerusalem, the Templars were eventually disbanded in 1312.

So who would step into the banking vacuum?

If you had been at the great fair of Lyon in 1555, you could have seen the answer. Lyon’s fair was the greatest market for international trade in all Europe.

But at this particular fair, gossip was starting to spread about an Italian merchant who was there, and making a fortune.

He bought and sold nothing: all he had was a desk and an inkstand.

Day after day he sat there, receiving other merchants and signing their pieces of paper, and somehow becoming very rich.

The locals were very suspicious.

But to a new international elite of Europe’s great merchant houses, his activities were perfectly legitimate.

He was buying and selling debt, and in doing so he was creating enormous economic value.

And that’s Harford’s mistake: there’s is nothing about the buying and selling of debt (or, for that matter, any other financial service, from changing money to issuing letters of credit) that creates value, enormous or otherwise.

Banking often enables value to be created. Surplus-value, too. But it doesn’t create either value or surplus-value.

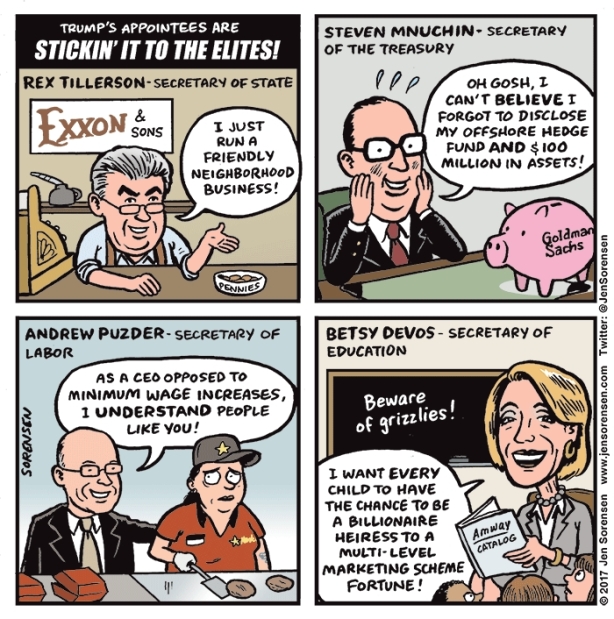

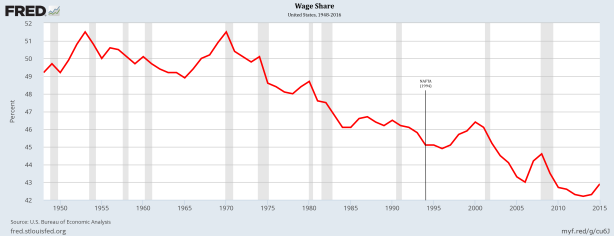

What bankers do is capture a portion of the surplus-value that is embodied in the goods and services that are produced, which is then distributed to them by those who actually appropriate the surplus-value. In other words, bankers (like many others, from managers to merchants) share in the booty.

Medieval bankers managed to get a cut of the surplus they did not create. And that’s exactly what bankers do today.

*Harford also notes that “by turning personal obligations into internationally tradable debts, these medieval bankers were creating their own private money, outside the control of Europe’s kings.” But he fails to mention the obvious contemporary parallel, Bitcoin, the private digital currency and payments system that was invented to finance criminal activities.