Special mention

Archive for September, 2017

Cartoon of the day

Posted: 30 September 2017 in UncategorizedTags: Afghanistan, cartoon, corporations, disaster, football, GOP, jobs, Obama, politics, Puerto Rico, racism, Republicans, rich, soldiers, tax cuts, tax reform, Trump

0

Mo’ better inequality blues

Posted: 29 September 2017 in UncategorizedTags: 1 percent, chart, income, inequality, United States, wealth

The latest Federal Reserve Board’s triennial Survey of Consumer Finances (pdf) is out and the news is not good—at least for the majority of Americans. They’re falling further and further behind those at the top.

Sure, on the surface, the results for the latest period of recovery from the Second Great Depression appear to be positive. Between 2013 and 2016, real gross domestic product in the United States grew at an annual rate of 2.2 percent, the civilian unemployment rate fell from 7.5 percent to 5 percent, and the annual rate of inflation averaged only 0.8 percent.

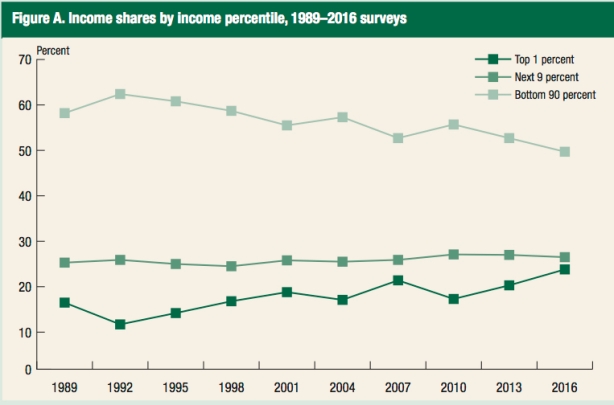

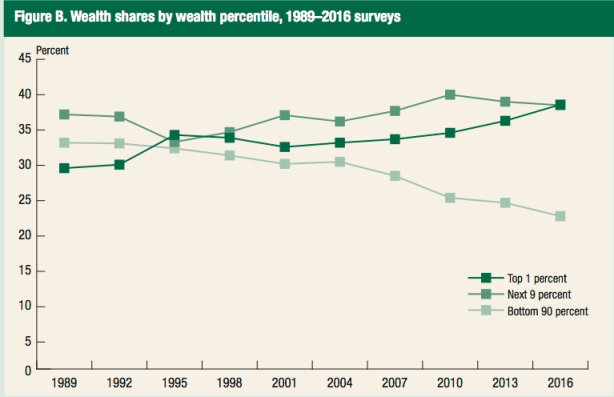

However, data from the 2016 Survey also indicate that the shares of income and wealth held by affluent households have reached historically high levels—and, for the bottom 90 percent, they continue to fall.

For example, examining the chart at the top of this post, the share of income captured by the top 1 percent of families, which was 20.3 percent in 2013, rose to 23.8 percent in 2016. The top 1 percent of families now receives nearly as large a share of total income as the next highest 9 percent of families combined (percentiles 91 through 99), who received 26.5 percent of all income—a share that has remained fairly stable over the past quarter of a century. Correspondingly, the rising income share of the top 1 percent mirrors the declining income share of the bottom 90 percent of the distribution, which fell to less than half (49.7 percent) in 2016.

And the degree of inequality in the distribution of wealth is even worse. The share of the top 1 percent climbed from 36.3 percent in 2013 to 38.6 percent in 2016, surpassing the wealth share of the next highest 9 percent of families combined. After rising over the second half of the 1990s and most of the 2000s, the wealth share of the next highest 9 percent of families has actually been falling since 2010, reaching 38.5 percent in 2016. Similar to the situation with income, the wealth share of the bottom 90 percent of families has been decreasing for most of the past 25 years, dropping from 33.2 percent in 1989 to only 22.8 percent in 2016.

Another way of illustrating the grotesquely unequal distribution of wealth in the United States is in terms of median net worth (as in the table above). As it turns out, the median net worth of the top decile is more than four times the level of the next highest decile group and more than 230 times that of the bottom two deciles—in both cases, even larger than the gaps that existed in 2013.

No one in charge—whether in the government, at the head of large corporations and banks, or in the discipline of economics—has a single idea or policy to offer to fix these growing income and wealth disparities.

And the rest of us? Once again, we’re learning to appreciate the “Feelin’ Bad Blues.”

Cartoon of the day

Posted: 29 September 2017 in UncategorizedTags: cartoon, environment, football, healthcare, inequality, plutocracy, profits, protest, racism, single-payer, Trump, United States

From highway to master

Posted: 28 September 2017 in UncategorizedTags: Adam Smith, banking, chart, corporations, finance, profits, United States, workers

Adam Smith’s Wealth of Nations makes for uncomfortable reading these days. That’s because, as my students this semester have learned, the father of modern mainstream economics—who has become so closely (and mistakenly) identified with the invisible hand—held a narrow theory of money and advocated extensive regulation of the banking sector.

This is contrast to the obscene growth of banking in recent decades, which Rana Foroohar observes “isn’t serving us, we’re serving it.”

According to Smith, the “judicious operations of banking” did nothing more than convert dead stock into active and productive stock—”into stock which produces something to the country.”

The gold and silver money which circulates in any country may very properly be compared to a highway, which, while it circulates and carries to market all the grass and corn of the country, produces itself not a single pile of either. The judicious operations of banking, by providing, if I may be allowed so violent a metaphor, a sort of waggon-way through the air, enable the country to convert, as it were, a great part of its highways into good pastures and corn-fields, and thereby to increase very considerably the annual produce of its land and labour.

Moreover, Smith also argued, banks were susceptible to speculative crises. Thus, even in his system of “natural liberty,” the banking sector needed to be regulated, in order to lessen the likelihood of such crises and to minimize the suffering of the poor when they did happen.

To restrain private people, it may be said, from receiving in payment the promissory notes of a banker, for any sum whether great or small, when they themselves are willing to receive them, or to restrain a banker from issuing such notes, when all his neighbours are willing to accept of them, is a manifest violation of that natural liberty which it is the proper business of law not to infringe, but to support. Such regulations may, no doubt, be considered as in some respects a violation of natural liberty. But those exertions of the natural liberty of a few individuals, which might endanger the security of the whole society, are, and ought to be, restrained by the laws of all governments, of the most free as well as of the most despotical. The obligation of building party walls, in order to prevent the communication of fire, is a violation of natural liberty exactly of the same kind with the regulations of the banking trade which are here proposed.

Those warnings and regulations, of course, disappeared from contemporary mainstream economics—even as the financial sector continued to increase in size and significance within the U.S. economy.

Today, financial profits (the blue line in the chart above) represent more than a quarter of total corporate profits in the United States, although the financial sector provides only 4.3 percent of American jobs (the red line in the chart).

Moreover, as the profits of the financial sector (the purple line in the chart above) have grown—reaching still another record high of more than $500 billion in 2016—the distribution of wealth has become more and more unequal—such that, in 2016, the share of total wealth owned by the top 1 percent (the green line in the chart) was more than 37 percent.

And it’s not just the financial sector. As Forohoor explains, corporations outside the banking sector are copying the spectacularly successful model:

Nonfinancial firms as a whole now get five times the revenue from purely financial activities as they did in the 1980s. Stock buybacks artificially drive up the price of corporate shares, enriching the C-suite. Airlines can make more hedging oil prices than selling coach seats. Drug companies spend as much time tax optimizing as they do worrying about which new compound to research. The largest Silicon Valley firms now use a good chunk of their spare cash to underwrite bond offerings the same way Goldman Sachs might.

The fact is, financial wheeling and dealing has—after a brief interlude—returned as the tail that wags the economic dog in the United States. It manages to capture an outsized share of profits, even as it creates increased instability and obscene levels of inequality.

It should be clear to all that finance has been fundamentally transformed since Smith’s day, from a highway that was supposed to serve us into a master that we serve.

Cartoon of the day

Posted: 28 September 2017 in UncategorizedTags: cartoon, climate change, football, fossil fuels, hurricanes, Puerto Rico, racism, Trump

Cartoon of the day

Posted: 27 September 2017 in UncategorizedTags: cartoon, football, GOP, healthcare, libertarian, mining, Obamacare, private property, protests, racism, repeal, Republicans, Trump

Cartoon of the day

Posted: 26 September 2017 in UncategorizedTags: cartoon, GOP, healthcare, Obamacare, opioids, poor, redistribution, Republicans, rich, United States, wealth

Cartoon of the day

Posted: 25 September 2017 in UncategorizedTags: cartoon, consumers, corporations, democracy, Obamacare, profits, rich, tax cuts, United States

Cartoon of the day

Posted: 24 September 2017 in UncategorizedTags: cartoon, CEOs, corporations, crisis, drilling, mining, oil, politics, refugees, Trump, United States, workers

Cartoon of the day

Posted: 23 September 2017 in UncategorizedTags: architecture, cartoon, Chelsea Manning, CIA, cities, GOP, Harvard, healthcare, Obamacare, Republicans