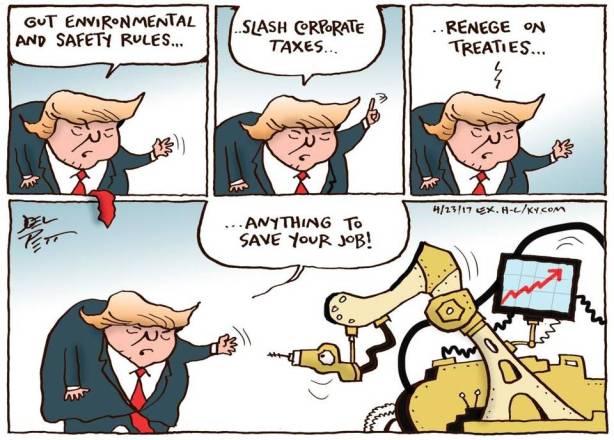

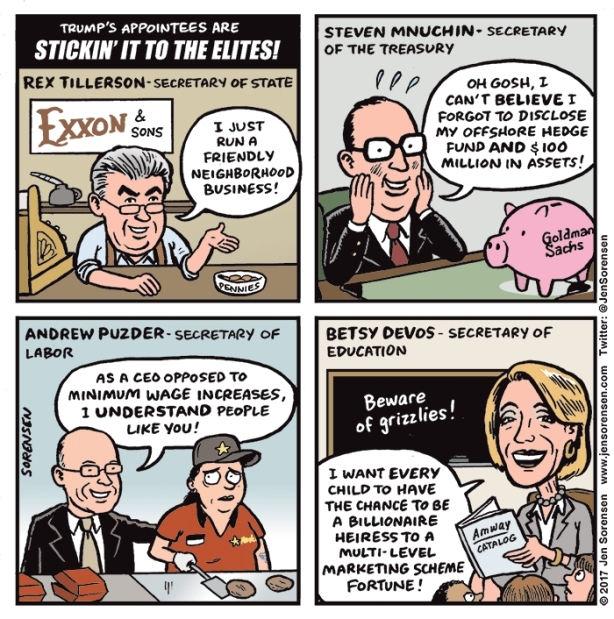

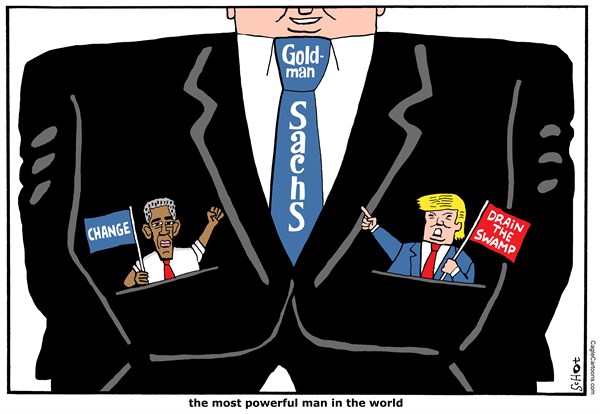

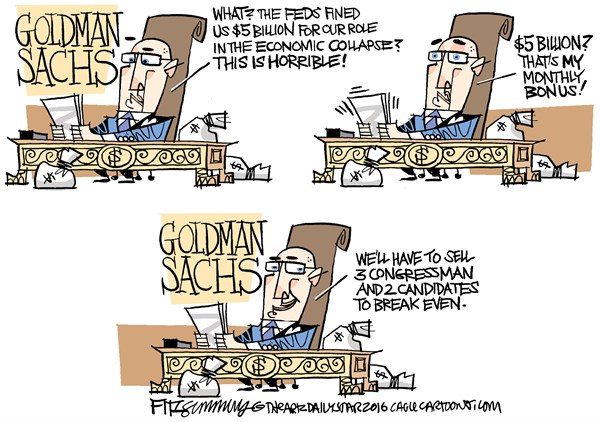

By now, many readers will have seen or heard Donald Trump’s call for the country to get back to work within the next couple of weeks, accompanied by a slew of other insidious and irresponsible remarks along the same lines—from business executives, politicians, and pundits, including ex-Goldman Sachs CEO Lloyd Blankfein, Texas Lt. Gov. Dan Patrick, and Fox News.

What can one say in response to such a blatant disregard for workers’ lives, all in an attempt to protect capitalism, restore private profits, and goose the stock market? Yesterday, Jack Amariglio, Professor of Economics Emeritus from Merrimack College, came up with the perfect rejoinder. . .

My modest proposal (no satire implied):

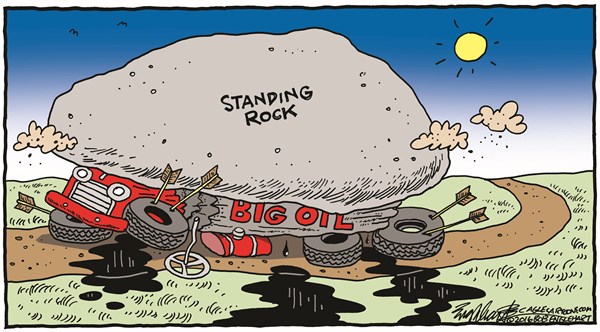

All those 1/10th-ers of the 1% and their political lackeys who are calling for “America to go back to work”—indeed, asserting that workers WANT to go back to work—should have to agree to the following conditions. I propose that ALL the health resources—ALL of them, or their monetary equivalent—that this sliver of the American population can and does command, either by ownership or by consumption, should be immediately transferred to all workers and non-workers in the United States as a precondition of “workers going back to work.”

In addition, this 1/10th of capitalist and financier loudmouths should work the most menial job (that is, “menial” in their opinion) in whatever companies or organizations they head or own or are a major shareholder in for the next full year beginning now. They should be made, or rather “agree,” to work this job for an average 8-hour day, 5 days a week minimum for this entire year. Moreover, the health coverage this elite should have access to should be the national average healthcare coverage of workers doing this particular job, whatever it is.

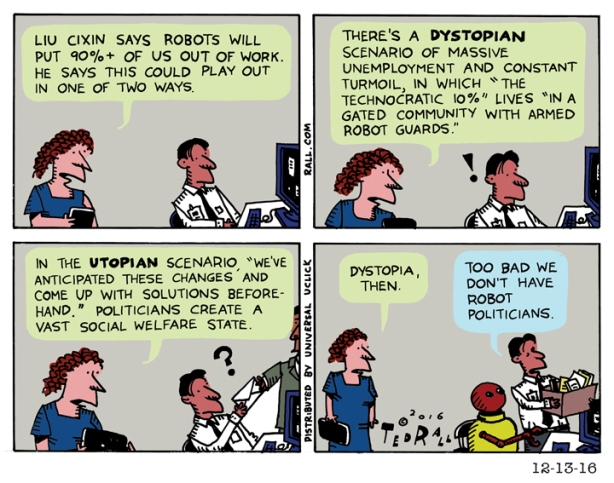

If they are willing to abide by these conditions—for starters—I for one would support Trump “reopening” the American economy, and workers going back to work knowing full well that doing so is going to kill at least 1-2% of them from COVID-19 in the coming year. Perhaps, in fact, some of that 1/10th will be killed off. But, of course, as some of them have said, that is the “patriotic” price they would have been willing to pay in order to make sure that “their children and grandchildren” have access to “the American dream.” If the 1/10th and their political mouthpieces are NOT willing to agree to these conditions—and that includes Trump and his sycophantish children—then they should immediately shut the fuck up and wait until the United States has at the very least “flattened the curve.” This is in lieu, for now, of Medicare for All and a Green New Deal, not to mention full paid leave and extended unemployment benefits for workers, a guaranteed annual income, and the equivalent for the self-employed and non-workers.

Please add to this or amend it as you see fit.