Special mention

Posts Tagged ‘liberal’

Cartoon of the day

Posted: 21 June 2020 in UncategorizedTags: cartoon, conservative, coronavirus, economics, liberal, pandemic, police, politics, slavery, spending, taxes, Trump, white supremacy

0

Tale of two depressions

Posted: 3 December 2018 in UncategorizedTags: 1 percent, conservative, economics, Great Depression, Great Recession, Jean Genet, liberal, mainstream, recovery, Second Great Depression, theater, wages, workers

Mainstream economists continue to discuss the two great crises of capitalism during the past century just like the pillars of society performed in the brothel—a “house of infinite mirrors and theaters”—in Jean Genet’s The Balcony.* The order they represent is indeed threatened by an uprising in the streets, and the only question is: can they reestablish the illusion of control?

The latest version of the absurdist economic play opens with Brad DeLong, who dons the costume of the liberal mainstream economist and argues that, while the Great Depression of the 1930s was far deeper than the Great Recession (what I have long referred to as the Second Great Depression), the recovery from the crash of 2007-08 was so mishandled that it casts a shadow over the U.S. economy in a way the first Great Depression did not.

now we are haunted by our Great Recession in a sense that our predecessors were not haunted by the Great Depression. Looking forward, it appears that we will be haunted for who knows how long. No unbiased observer projects anything other than slow growth, much slower than the years during and after World War II. Nobody is forecasting that the haunting will cease — that the shadow left from the Great Recession will lift.

Basically, DeLong blames two groups—conservative mainstream economists and policymakers (“including the decision makers at the top in the Obama administration”)—for a recovery that was both too long and too slow. The first claims the monetary and fiscal policies that were adopted were wrongheaded from the start, and fought every attempt to sustain or expand them. The second group claims they prevented a second Great Depression and refuses to acknowledge the failure of the policies they devised and adopted.

The customer who dresses up as a representative of the conservative wing of mainstream economics, Robert Samuelson, expresses his sympathy with DeLong’s analysis but considers it be overstated. Samuelson’s view is that slow growth is not caused by the shadow cast by inadequate economic policies, but is the more or less inevitable result of two exogenous events: reduced growth of the labor force and slower growth in productivity.

The retirement of baby-boom workers would have occurred without the Great Recession. The slowdown in productivity growth — reflecting technology, management and worker skills — is not well understood, but may also be independent of the Great Recession.

This is exactly what is to be expected in the high-end economic brothel. It’s a debate confined to growth rates and the degree to which economic policies or exogenous factors should ultimately shoulder the blame of the crisis of legitimacy of the current economic order. Each, it seems, wants to play the fantasy of the Chief of Police in order to create the illusion of restoring order.**

What DeLong and Samuelson choose not to talk about are the fundamental differences between the response to the 1929 crash and the most recent crisis of capitalism. As is clear from the data in the chart at the top of the post, the balance of power was fundamentally altered as a result of the New Deals (the first and especially the second), which simply didn’t occur in recent years. After 1929, the wage share (the green line) remained relatively constant, even in the face of massive unemployment—and eventually, as a result of a whole series of other policies (from regulating the financial sector through jobs programs to unleashing a wave of labor-union organizing), the shares of national income going to the bottom 90 percent (the blue line) and the top 1 percent (the red line) moved in opposite directions. The current recovery has been quite different: a declining wage share (which, admittedly, continues a decades-long slide), the bottom 90 percent losing out and the top 1 percent resuming its rise.

And the reason? As I see it, what was happening outside the brothel, in the streets, explains the different responses to the two crashes. It was the Left—in the form of political parties (Socialist, Communist, and the left-wing of the Democratic Party), but also labor unions, councils of the unemployed, academics, and so on—that pushed the administration of Franklin Delano Roosevelt and Congress to adopt policies that moved beyond restoring economic growth to fundamentally restructure the U.S. economy (which, of course, continued during and after the war years).*** Nothing similar happened in the United States after 2008. As a result, the policies that were discussed and eventually adopted only meant a recovery for large corporations and wealthy households. Everyone else has been left to battle over the scraps—attempting to get by on low-paying jobs retirement incomes based on volatile stock markets, with underwater mortgages and rising student debt, and facing out-of-control healthcare costs.****

It should come as no surprise, then, that the elites who continue to play out their fantasies in the house of mirrors have lost the trust of ordinary people. Unfortunately, in the wake of the Second Great Depression, it’s clear that new masqueraders have been willing to don the costumes and continue the fantasy that the old order can be restored.

Only a fundamental rethink, which rejects all the illusions created within the economic bordello, will chart a path that is radically different from the recoveries that followed both great crises of capitalism of the past hundred years.

*I saw my first production of “O Balcão” at Sao Paulo’s Teatro Oficina in 1970, as a young exchange student during one of the most repressive years of the Brazilian dictatorship. Staging Genet’s play at that moment represented both a searing critique of the military regime and an extraordinary act of resistance to government censorship.

**Much the same can be said of a parallel debate, between Joseph Stiglitz and Lawrence Summers.

***Even then, we need to recognize how limited the recovery from the first Great Depression was. Amidst all the changes and new regulations, leaving control of the surplus in private hands left large corporations with the interest and means to circumvent and ultimately eliminate the New Deal regulations, thus creating the conditions for the Second Great Depression.

****As Evan Horowitz has shown, roughly 14 percent of workers have seen no raise over the past year (counting only those who have stayed in the same job). That means, with inflation, their real wages have fallen. Moreover, “when a large share of workers get passed over for raises, wage growth for all workers tends to remain slow in the year ahead.”

Cartoon of the day

Posted: 27 October 2018 in UncategorizedTags: Brazil, cartoon, conservative, fascism, liberal, military, tax cuts, taxes, trickledown, Trump

Stiglitz vs. Summers

Posted: 9 October 2018 in UncategorizedTags: capitalism, crash, crisis, economics, Great Depression, inequality, Joseph Stiglitz, Larry Summers, liberal, macroeconomics, mainstream, policy, Second Great Depression, theory, United States

Two giants of mainstream economics—Joseph Stiglitz and Lawrence Summers—have been engaged in an acrimonious, titanic battle in recent weeks. The question is, what’s it all about? And, even more important, what’s at stake in this debate?

At first glance, the intense, even personal back-and-forth between Stiglitz and Summers seems a bit odd. Both economists are firmly in the liberal wing of mainstream economics and politics—as against, for example, Gene Epstein (an Austrian economist, who accuses Stiglitz of regularly siding with left-wing populists like Hugo Chávez) or John Taylor (a committed supply-sider, who has long been suspicious of “demand-side discretionary stimulus packages”). Both Stiglitz and Summers have pointed out the limitations of monetary policy, especially in the midst of deep economic recessions, and have favored relatively large fiscal-policy interventions, a hallmark of mainstream liberal economic policy.

One might be tempted to see it as merely a clash of outsized egos, which of course is not at all rare among mainstream economists. Their exaggerated sense of self-importance and intellectual arrogance are legion. Neither Stiglitz nor Summers has ever been accused of being a shrinking-violet when it comes to debates in the many academic and policy-related positions they’ve held.* And there’s certainly a degree of personal animus behind the current debate. Apparently, Summers [ht: bn] successfully lobbied in 2000 for Stiglitz’s removal from the World Bank, reportedly as a condition of the reappointment of Jim Wolfensohn as President of the World Bank. And, in 2013, Stiglitz came out strongly in favor of Janet Yellen, over Summers, for head of the Federal Reserve.**

That’s certainly part of the story. And the personal attacks and evident animosity from both sides have attracted a great deal attention of onlookers. But I think much more is at stake.

The current debate began with the critique Stiglitz leveled at the notion of “secular stagnation,” which Summers has championed starting in 2013 as an explanation for the slow recovery of the U.S. economy after the crash of 2007-08. The worry among many mainstream economists has been that, given the severity and duration of the Second Great Depression, capitalism could no longer deliver the goods.*** In particular, Summers invoked the specter of persistently slow growth, which had originally been put forward in the midst of the first Great Depression by Alvin Hansen, created by demography: the decrease in the number of available workers, itself a result of the declines in the rate of population growth and the labor force participation rate. The worry is that, looking forward, there simply won’t be enough workers to sustain the rates of potential economic growth we saw in the years leading up to the most recent crisis of capitalism. In the meantime, Summers, in traditional Keynesian fashion, expressed his support for raising the level of aggregate demand, through public and private spending, even at low real interest rates (which, in his view, were incapable of fulfilling their traditional role of boosting spending).****

Stiglitz for his part has dismissed the idea of secular stagnation, as “an excuse for flawed economic policies” (especially the inadequate stimulus package proposed and enacted by the administration of Barack Obama), and put forward an alternative analysis for capitalism’s slow growth problem: its inability to manage structural transformations of the economy. According to Stiglitz, the shift from manufacturing-led growth to services-led growth characterized the U.S. economy in the years before the most recent crash, analogous to the manner in which the crisis in agriculture “led to a decrease in demand for urban goods and thus to an economy-wide downturn” in the lead-up to the depression of the 1930s. Thus, in his view, World War II brought about a structural transformation in the United States (“as the war effort moved large numbers of people from rural areas to urban centers and retrained them with the skills needed for a manufacturing economy”) but nothing similar was undertaken in the wake of the crash of 2007-08.

The Obama administration made a crucial mistake in 2009 in not pursuing a larger, longer, better-structured, and more flexible fiscal stimulus. Had it done so, the economy’s rebound would have been stronger, and there would have been no talk of secular stagnation.

These are the terms of the theoretical debate, then, between Stiglitz and Summers: a focus on sectoral shifts versus a worry about secular stagnation. The first concerns the way the private forces of American capitalism have been inept in handling structural transformations of the economy, while the second focuses on ways in which “the private economy may not find its way back to full employment following a sharp contraction.”

For my part, both stories have an important role to play in making sense of both economic depressions—the first as well as the second. The problem is, neither Stiglitz nor Summers has presented an analysis of how American capitalism created the conditions for either crash. Stiglitz does not explain how the crisis in agriculture in the 1920s or the move away from manufacturing in recent decades was created by tendencies within existing economic institutions. Similarly, Summers does not conduct an analysis of the changes in U.S. capitalism that, in addition to producing lower growth rates, led to the massive downturn beginning in 2007-08. Their respective approaches are characterized by exogenous event rather than the endogenous changes leading to instability one might look for in a capitalist economy.

Moreover, both Stiglitz and Summers presume that the appropriate stimulus project will fulfill the mainstream macroeconomic utopia characterized by levels of output and a price level that corresponds to full employment and price stability. There is nothing in either of their approaches that recognizes capitalism’s inherent instability or its tendency, even in recovery, of generating one-sided outcomes. For Stiglitz, “the challenge was—and remains—political, not economic: there is nothing that inherently prevents our economy from being run in a way that ensures full employment and shared prosperity.” Similarly, Summers emphasizes the way “fiscal policies and structural measures to support sustained and adequate aggregate demand” can overcome the problems posed by secular stagnation. In other words, both Stiglitz and Summers redirect attention from capitalism’s own tendencies toward instability and uneven recoveries and focus instead on the set of economic policies that in their view are able to create full employment and price stability.

Finally, while Stiglitz and Summers mention en passant the problem of growing inequality, neither takes the problem seriously, at least in terms of analyzing the conditions that led to the crash of 2007-08—or, for that matter, the lopsided nature of the recovery. There’s nothing in the debate (or in their other writings) about how rising inequality across decades, based on stagnant wages and record profits, served to dismantle government regulations on the financial sector (because those who received the profits had both the means and interest to do so) and to propel the tremendous growth (on both the demand and supply sides) of financial activities within the U.S. economy. Nor is there a discussion of how focusing on the recovery of banks, large corporations, and the incomes and wealth of a tiny group at the top was based on a deterioration of the economic and social conditions of everyone else—much less how a larger stimulus package would have produced a substantially different outcome.

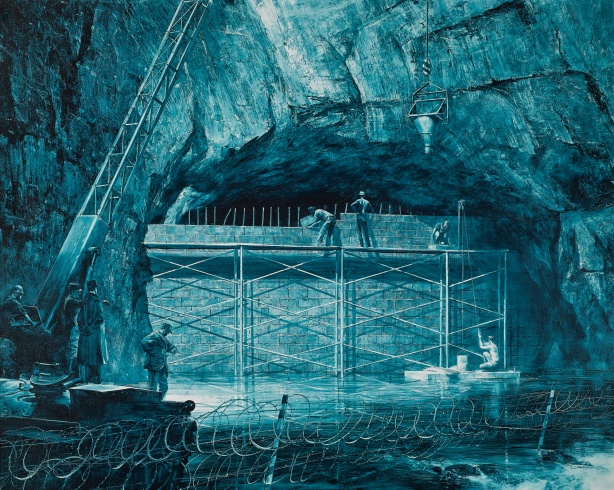

The fact is, the debate between Stiglitz and Summers is based on a discussion of terms and a mode of analysis that are firmly inscribed within the liberal wing of mainstream economics. Focusing on the choice between one or the other merely to serves to block, brick by brick, the development of much more germane approaches to analyzing the conditions and consequences of the ways American capitalism has been characterized by fundamental instability and obscene levels of inequality—today as in the past.

*Stiglitz is a recipient of the John Bates Clark Medal (1979) and the Nobel Prize in Economics (2001). He served as the Chair of Bill Clinton’s Council of Economic Advisers (1995-1997) and Chief Economist at the World Bank (1997-2000). He is currently a professor of economics at Columbia University (since 2001). Summers is former Vice President of Development Economics and Chief Economist of the World Bank (1991–93), senior U.S. Treasury Department official throughout Clinton’s administration (ultimately Treasury Secretary, 1999–2001), and former director of the National Economic Council for President Obama (2009–2010). He is a former president of Harvard University (2001–2006), where he is currently a professor and director of the Mossavar-Rahmani Center for Business and Government at Harvard’s Kennedy School of Government.

**My choice, for what it’s worth, was Federal Reserve Governor Sarah Raskin.

***As I explained in 2016, contemporary capitalism has a slow-growth problem—”because growth is both a premise and promise of a particularly capitalist way of organizing our economic activities.”

****An archive of Summers’s various blog posts on secular stagnation can be found here.

Don’t worry?!

Posted: 11 December 2017 in UncategorizedTags: automation, economics, epistemology, exploitation, inequality, liberal, mainstream, numbers, productivity, reserve army, workers

Liberal mainstream economists all seem to be lip-synching Bobby McFerrin these days.

Worried about automation? Be happy, write Laura Tyson and Susan Lund, since “these marvelous new technologies promise higher productivity, greater efficiency, and more safety, flexibility, and convenience.”

Worried about the different positions in current debates about economic policy? Be happy, writes Justin Wolfers, and rely on the statistics produced by government agencies and financial firms and the opinions of mainstream economists.

Me, I remain worried and I have no reason to accept mainstream economists’ advice for being happy.

Sure, new forms of automation might lead to higher productivity and much else that Tyson and Lund find so alluring. But who’s going to benefit? If we go by the last few decades, large corporations and wealthy individuals are the ones who are going to capture most of the gains from the new technologies. Everyone else, as I have written, is going to be forced to have the freedom to either search for new jobs or deal with the fundamental transformation of the jobs they manage to keep.

When it comes to separating fact from fiction, aside from the embarrassing epistemological positions liberals rely on, where are the statistics that might help us make sense of what is going on out there—numbers like the Reserve Army of Unemployed, Underemployed, and Low-wage Workers or the rate of exploitation.

You want me not to worry? Analyze what’s going to happen to workers and the distribution of income as automation increases and calculate the kinds of economic numbers other theoretical traditions have produced.

Even better, let workers have a say in what and how new technologies are introduced and change economic institutions in order to eliminate the Reserve Army and class exploitation.

Then and only then will I be happy.

“Labour is a disgrace”

Posted: 23 March 2017 in UncategorizedTags: conservative, dignity, Friedrich Nietzsche, government, labor, liberal, slavery, wage-labor, white, workers, working-class

Banksy, “Untitled” (2009)

On first glance, liberals and conservatives agree on very little these days, especially now that we find ourselves in the era of Donald Trump. But they do seem to find common ground on one thing: the so-called dignity of labor.

Let me explain. In the article I referred to yesterday, conservative Arthur Brooks invokes the “dignity of labor” as the reason anything and everything should be done to stem the fall in the labor-force participation rate of white men and get them back to work.

If its goal is to instill dignity, the U.S. government does not need to find more innovative ways to “help” people; rather, it must find better ways to make them more necessary. The question for leaders, no matter where they sit on the political spectrum, must be, Does this policy make people more or less needed—in their families, their communities, and the broader economy?

Some may ask whether making people necessary is an appropriate role for government. The answer is yes: indeed, it represents a catastrophic failure of government that millions of Americans depend on the state instead of creating value for themselves and others. However, it’s not enough to merely make people feel that they are needed; they must become more authentically, objectively necessary.

The single most important part of a “neededness agenda” is putting more people to work.

Well, as it turns out, one of Brooks’s liberal critics, Lane Kenworthy, actually agrees that working for someone else and producing more than one needs has “significant virtues”:*

It imposes regularity and discipline on people’s lives. It can be a source o mental stimulation. It helps to fulfill the widespread desire to contribute to, and be integrated in, the larger society. It shapes identity and can boost self-esteem. With neighborhood and family ties weakening, the office or factory can be a key site of social interaction. Lack of employment tends to be associated with feelings of social exclusion, discouragement, boredom, and unhappiness. Societies also need a significant majority of people in paid work to help fund government programs.

No matter the fundamental differences in the policies they advocate, Brooks and Kenworthy are in fundamental agreement that people should believe in the dignity of work and government policy should be redesigned to make sure people—especially the members of the white working-class—get back to work.

I have already dealt numerous times (e.g, here, here, and here) with the argument that participating in wage-labor is intrinsically dignified. But the question remains, why should the government be brought in—in the eyes of by both conservatives and liberals—to make sure people are forced to have the freedom to acquire that dignity?

The answer actually lies in an unexpected source. According to Friedrich Nietzsche (in his 1871 preface to an unwritten book, “The Greek State”), the dignity of labor was invented as one of the “needy products of slavedom hiding itself from itself.” That’s because, in Nietzsche’s view (following the Greeks), labor is only a “painful means” for existence and existence (as against art) has no value in itself. Therefore, “labour is a disgrace.”

Accordingly we must accept this cruel sounding truth, that slavery is of the essence of Culture; a truth of course, which leaves no doubt as to the absolute value of Existence. This truth is the vulture, that gnaws at the liver of the Promethean promoter of Culture. The misery of toiling men must still increase in order to make the production of the world of art possible to a small number of Olympian men.

And if slaves—or, today, wage-workers—no longer believe in the “dignity of labour,” it falls to the likes of both conservatives and liberals to ignore the “disgraced disgrace” of labor and create the necessary “conceptual hallucinations.” And then, on that basis, to suggest the appropriate government policies such that the “enormous majority [will], in the service of a minority be slavishly subjected to life’s struggle, to a greater degree than their own wants necessitate.”

Nietzsche believed that, in the modern world, the so-called dignity of labor was one of the “transparent lies recognizable to every one of deeper insight.” Apparently, neither Brooks nor Kenworthy can count himself among those with such insight.

*This is even after Kenworthy admits “employment is not always a good thing.”

The need for a paycheck can trap people in careers that divert them from more productive or rewarding pursuits. Paid work can be physically or emotionally stressful. It can be monotonous, boring, alienating. Some jobs require a degree of indiference, meanness, or dishonesty toward customers or subordinates that eats away at one’s humanity. And work can interfere with family life.

Populism and mainstream economics

Posted: 2 March 2017 in UncategorizedTags: Brexit, capitalism, conservative, economics, economists, free markets, inequality, just deserts, liberal, mainstream, minimum wage, NAFTA, populism, stability, Trump, truth

There doesn’t seem to be anything remarkable about mainstream economists’ rejection of the new populism.

Lest we forget, mainstream economists in the United States and Europe (and, of course, around the world) mostly celebrated current economic arrangements. As far as they were concerned, everyone benefits from contemporary globalization (the more trade the better) and from the distribution of income created by market forces (since everyone gets what they deserve).

To be sure, those who identify with different wings of mainstream economics debate the extent to which there are market imperfections and therefore how much interference there should be in markets. Conservative mainstream economists tend to argue in favor of less regulation, their liberal counterparts for more government intervention. But they share the same general economic vision—that capitalism is characterized by “just deserts,” stable growth, and rising standards of living.

Except of course in recent decades it hasn’t. Not by a long shot.

Inequality has skyrocketed to obscene levels (and continues to rise), leaving many people behind. The crash of 2007-08 shattered the illusion of stability—and now there’s a deepening worry of “secular stagnation” moving forward. And, while the conspicuous consumption of the tiny group at the top continues unabated, only rising debt keeps everyone else from falling down the ladder.

No wonder, then, that economic populists, especially those on the Right, are rejecting the status quo—and winning campaigns and elections (often in the form of protest votes).

For the most part, to judge by Brigitte Granville’s survey of a variety of Project Syndicate commentators’ responses to populism, mainstream economists remain blind as to “why so many voters have embraced facile policies and populist politics.”

That’s pretty much what one would expect, given mainstream economists’ general commitment to the status quo.

But even when they admit that “much has gone wrong for a great many people,” as Margaret MacMillan does (“Globalization and automation are eliminating jobs in developed countries; powerful corporations and wealthy individuals in too many countries are getting a greater share of the wealth and paying fewer taxes; and living conditions continue to deteriorate for people in the US Rust Belt or Northeast England and Wales”), we read the spectacular claim that today’s populists—these “new, outsider political forces”—are wrong because they “claim to have a monopoly on truth.”

Now, I understand, MacMillian is a historian, not an economist. But the idea that populists are somehow the only ones who claim to have a monopoly on truth is an extraordinary diagnosis of the problem.

Think of the legions of mainstream economists who have lined up over the years to claim a monopoly on the truth concerning a wide variety of policies, from restricting minimum wages and approving NAFTA to deregulating finance and voting no on Brexit. They are the ones who have aligned themselves with the interests of economic and political elites and who, in the name of expertise, have attempted to trump democratic, public discussion of important economic issues.

It should come as no surprise, then, that mainstream economists—such as Harvard’s Sendhil Mullainathan—are so concerned that economists have been demoted within the new Trump administration. The horror! The chairperson of the Council of Economic Advisers is not going to be a member of the Cabinet.

Yes, it is true, business acumen is not the same as economic analytics. (I teach economics in a College of Arts and Letters, not in a business school—and, as I remind my students on a regular basis, I’m the last person they should turn to for investment or business advice.) But that’s a far cry from claiming a monopoly on the truth, which is only available to those who speak and write in the language of mainstream economics.*

If mainstream economists finally relinquished that claim—and, as a result, spent more time both learning the languages of other traditions within the discipline of economics and listening to the grievances and desires of those who have been sacrificed at the altar of the status quo—perhaps then they’d have something useful to contribute to the larger debate about where the world is headed right now.

*According to Andrea Brandolini, the late Tony Atkinson understood this: “‘Economists are too often prisoners within the theoretical walls they have erected’, he recently wrote discussing austerity policies, ‘and fail to see that important considerations are missing”

Profits and poverty

Posted: 26 September 2016 in UncategorizedTags: chart, conservative, corporations, liberal, Marx, poverty, profits, United States

Provoked, first, by liberal celebrations of the recent decline in the poverty rate in the United States—and, then, by conservative attempts to dismiss the issue of inequality, I decided to run some numbers. Just to see.

As it turns out, the corporate profit share (on the right in the chart above) and the poverty rate (on the left) appear to have moved in tandem since the mid-1990s: when the profit share declines, so does the poverty rate, and vice versa.

This is one of those times when I don’t have a theory or an explanation. But I was reminded of that long-forgotten ruthless critic of political economy:

Accumulation of wealth at one pole is, therefore, at the same time accumulation of misery, agony of toil slavery, ignorance, brutality, mental degradation, at the opposite pole, i.e., on the side of the class that produces its own product in the form of capital.

Elite divisions?

Posted: 12 July 2016 in UncategorizedTags: capitalism, conservative, economics, economists, elites, free markets, invisible hand, liberal, mainstream

As if in direct response to one of my recent posts on “ignoring the experts,” the best mainstream economist Noah Smith can come up with is there is no single, unified elite opinion—perhaps on Brexit but not on most economic issues.

The “elite” isn’t a single unified bloc. There are many different kinds of elites. Politicians, bureaucrats, wealthy businesspeople, corporate managers, financiers, academics and media personalities can all be labeled elites. But there are huge fissures and rivalries both within and between these groups. They are almost never in broad agreement on any issue — Brexit was the exception, not the rule.

That’s not saying much. Of course, elites and elite opinions are divided. They have always have been and certainly are now.

The issue is not whether different groups or fractions within the elite hold different opinions, but the limits of those differences and the views that are marginalized or excluded as a result.

Consider the views of mainstream economists (which is really what my original post was about). They hold different views about most economic issues—from labor markets to international trade—but the range of differences is very narrow. As I explained back in January:

while conservative mainstream economists believe that efficiency, growth, and full employment stem from allowing markets to operate freely, liberal mainstream economists argue that markets are often imperfect and therefore the only way to achieve (or at least approximate) those goals is to intervene in and regulate markets. Those are the terms of the mainstream debate in economics, from the origins of modern economic discourse in the late-eighteenth century right on down to the present.

Think about it as the difference between the invisible hand and the visible hand.

Liberal mainstream economists, of course, hotly contest the free-market doctrine of their conservative counterparts. But notice also that they hold in common both the goals and the limits of economic policy with conservatives. Liberals and conservatives share the idea that the goals of an economy are to ensure efficiency, growth, and full employment. And they share the idea that economic policy should be limited to tinkering with capitalism—in the direction of more regulation or, for conservatives, more free markets—in order to achieve those goals.

That’s it, the limits of the mainstream debate.

Mainstream economists use different theories and promote different policies within those narrow limits. What they exclude are theories and policies that fall outside those limits—and thus, in their view, don’t deserve a hearing.

Their expertise ends when it comes to theories that focus on such things as the inherent instability of capitalism or the role of class in determining the value of goods and services and the distribution of income. And they exclude policies that either change the fundamental rules of capitalism or look beyond capitalism, to alternative ways of organizing economic and social life.

What that means, concretely, is mainstream economists tend to minimize the damage—to different groups of people and to society as a whole—of existing economic arrangements. Just as Paul Krugman minimizes the loss of jobs from deindustrialization (“we’re talking about 1.5 percent of the work force”), Smith understates the disruptive effects of globalization (in referring to “some economic setbacks” for the middle-class of rich nations while presuming everyone else has gained).

So, yes, mainstream economists (like the elites whose position they never contest) often find themselves disagreeing among themselves about theories and policies. But it’s precisely because the limits of their disagreements are so narrow, there’s always a surplus of meaning that falls outside of and escapes their purview. That’s when alternative theories and policies flourish—and all mainstream economists can do is invoke their self-professed expertise to attempt to quash the alternatives and relegate them to (or beyond) the margins.

Sometimes, of course, it works and non-elite opinion falls in line. But other times—after the crash of 2007-08, in the lead-up to the Brexit vote, and so on—it doesn’t and the narrow limits of expert opinion are challenged, parodied, or ignored. And other possibilities, always just below the surface, acquire new resonance.

Elites, who simply can’t or don’t want to understand, suggest the masses just eat cake (or, today, crack)—and, like Smith, hide behind the idea that “there are no easy answers to the challenges of the modern global economy.”

Life among the liberal econ

Posted: 26 April 2016 in UncategorizedTags: Axel Leijonhuvud, capitalism, economics, liberal, mainstream, Marx, politics

Mark Tansey, Recourse (2011)

One of the great advantages of economics graduate programs outside the mainstream (like the University of Massachusetts Amherst, where I did my Ph.D.) is we were encouraged to read, listen to, and explore ideas outside the mainstream—especially the liberal mainstream.

The liberal mainstream at the time, not unlike today, consisted of neoclassical microeconomics (with market imperfections) and a version of Keynesian macroeconomics (which was, in the usual IS-LM models, best characterized as hydraulic or bastard Keynesianism). Essentially, what liberal economists offered was a theory of a “mixed economy” that could be made to work—both premised on and promising “just deserts” and stable growth—with an appropriate mix of private property, markets, and government intervention.

For many of us, liberal mainstream economics was a dead end—uninspired and uninspiring both theoretically and politically. Theoretically, it marginalized history (both economic history and the history of economic thought) and ignored the exciting methodological debates taking place in other disciplines (from discussions of paradigms and scientific revolutions through criticisms of essentialism and determinism to fallibilist mathematics and posthumanism). And politically, it ignored many of the features of real capitalism (such as poverty, inequality, and class exploitation) and rejected any and all alternatives to capitalism (in a liberal version of Margaret Thatcher’s “there is no alternative”).

Then as now, what liberal economists offer was, as Gerald Friedman has recently pointed out, a “political economy of despair.”

The reaction to my paper — the casual and precipitous conclusion that it must be wrong because it projects a sharply higher rate of GDP growth — comes from the assumption that the economy is already at full employment and capacity output. It is assumed that were output significantly below full employment, then prices would fall to equilibrate the two. This is the political counsel of despair. It is based on classical economic theory and the underlying acceptance of Say’s Law of Markets (named for the great Classical economist Jean-Baptiste Say), which says that total supply of goods and services and the total demand for goods and services will always be equal. The shoe market creates the right amount of demand for shoes — it works out so neatly that the true measure of the supply of shoes, of potential output, can be taken by measuring actual output. This concept is used as a justification for laissez-faire economics, and the view that the market mechanism finds a harmonious equilibrium. . .

There is, of course, a politics as well as a psychology to this economic theory. If nothing much can be done, if things are as good as they can be, it is irresponsible even to suggest to the general public that we try to do something about our economic ills. The role of economists and other policy elites (Paul Krugman is fond of the term “wonks”) is to explain to the general public why they should be reconciled with stagnant incomes, and to rebuke those, like myself, who say otherwise before we raise false hopes that can only be disappointed.

Fortunately, back in graduate school and continuing after we received our degrees, we were encouraged to look beyond liberal economics—both outside the discipline of economics (in philosophy, history, anthropology, and so on) and within the discipline (to strains or traditions of thought that developed criticisms of and alternatives to liberal mainstream economics).

Marx was, of course, central to our theoretical explorations. But so were other thinkers, such as Axel Leijonhufvud (whose work I’ve discussed before). He—along with others, such as Robert Clower and Hyman Minsky—challenged the orthodox interpretation of Keynes, especially the commitment to equilibrium. Leijonhufvud was particularly interested in what happens within a commodity-producing economy when exchanges take place outside of equilibrium.

The orthodox Keynesianism of the time did have a theoretical explanation for recessions and depressions. Proponents saw the economy as a self-regulating machine in which individual decisions typically lead to a situation of full employment and healthy growth. The primary reason for periods of recession and depression was because wages did not fall quickly enough. If wages could fall rapidly and extensively enough, then the economy would absorb the unemployed. Orthodox Keynesians also took Keynes’ approach to monetary economics to be similar to the classical economists.

Leijonhufvud got something entirely different from reading the General Theory. The more he looked at his footnotes, originally written in puzzlement at the disparity between what he took to be the Keynesian message and the orthodox Keynesianism of his time, the confident he felt. The implications were amazing. Had the whole discipline catastrophically misunderstood Keynes’ deeply revolutionary ideas? Was the dominant economics paradigm deeply flawed and a fatally wrong turn in macroeconomic thinking? And if this was the case, what was Keynes actually proposing?

Leijonhufvud’s “Keynesian Economics and the Economics of Keynes” exploded onto the academic stage the following year; no mean feat for an economics book that did not contain a single equation. The book took no prisoners and aimed squarely at the prevailing metaphor about the self-regulating economy and the economics of the orthodoxy. He forcefully argued that the free movement of wages and prices can sometimes be destabilizing and could move the economy away from full employment.

That helped understand the Great Depression. At that period, wages [were] highly flexible and all that seemed to occur as they fell was further devastating unemployment. Being true to Keynes’ own insights, he argued, would require an overhaul of macroeconomic theory to place the problems of coordination and information front and center. Rather than simply assuming that price and wage adjustments would cause the economy to restore an appropriate level of output and employment, he suggested a careful analysis of the actual adjustment process in different economies and how the economy might evolve given these processes. As such, he was proposing a biological or cybernetic approach to economics that saw the economy more as an organism groping forward through time, without a clear destination, rather than a machine that only occasionally needed greasing.

That “path not taken” might also have helped us understand the Second Great Depression and the uneven—and spectacularly unequalizing—recovery that liberal mainstream economists have supervised and celebrated in recent years.

Meanwhile, the rest of us continue to look elsewhere, beyond the liberal political economy of despair, for economic and political ideas that create the possibility of a better future.