Posts Tagged ‘blacks’

Cartoons of the day

Posted: 7 October 2020 in UncategorizedTags: blacks, cartoons, election, evictions, health insurance, Kamala Harris, Mike Pence, slavery, taxes, Trump, unemployment

0

Cartoons of the day

Posted: 29 September 2020 in UncategorizedTags: American Dream, Big Tech, blacks, capitalism, cartoons, climate crisis, deaths, healthcare, jobs, military, schools, taxes, Trump, voters

Chart of the day

Posted: 10 July 2020 in UncategorizedTags: blacks, chart, coronavirus, pandemic, reserve army, Second Great Depression, underemployment, unemployment, United States, whites, workers, world

Since the first of June,

Lost my job and lost my room.

I pretend to try,

Even though I tried alone.

— Sufian Stevens, “Flint (For the Unemployed and Underpaid)”

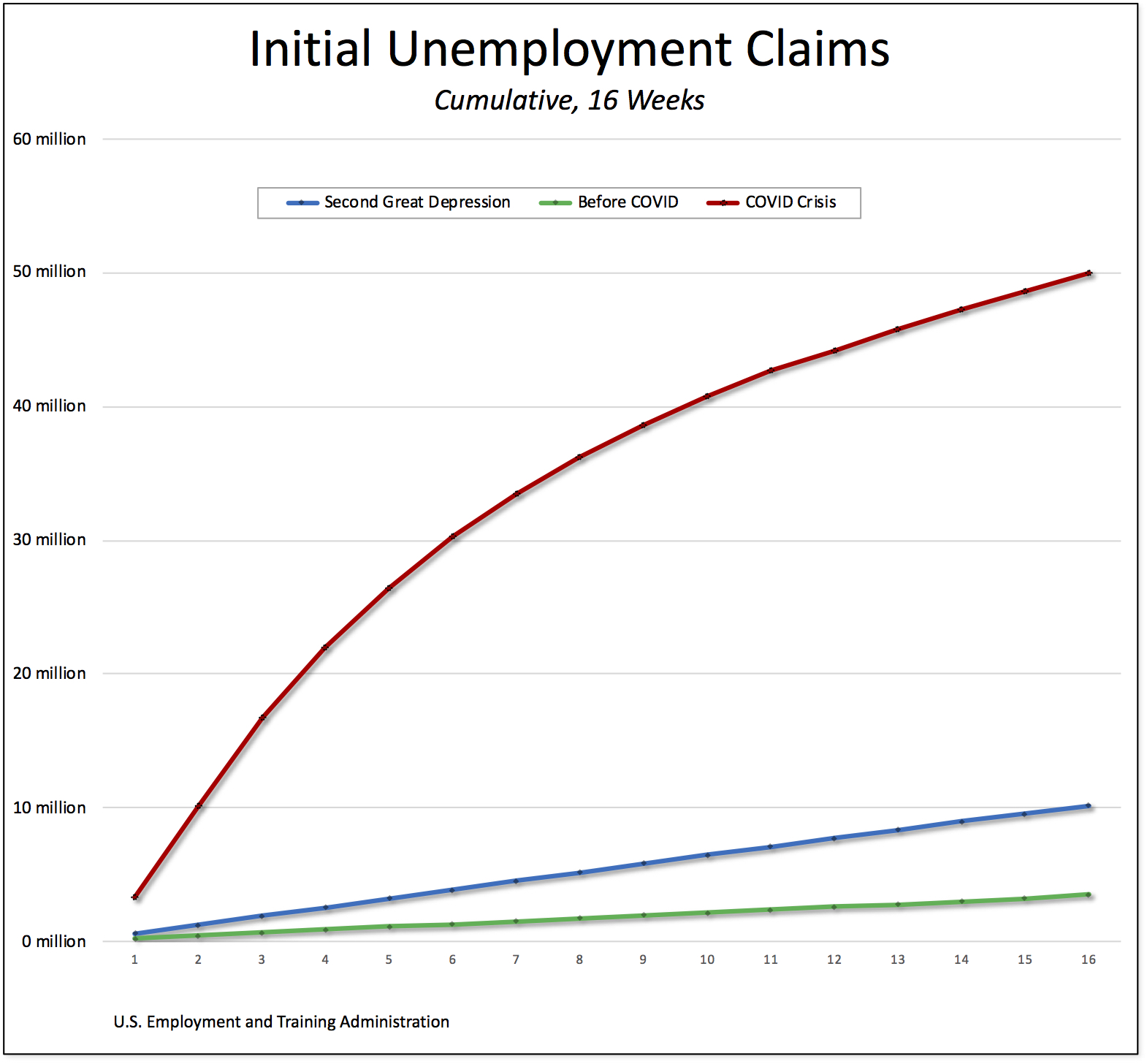

Yesterday morning, the U.S. Department of Labor (pdf) reported that, during the week ending last Saturday, another 1.3 million American workers filed initial claims for unemployment compensation. That’s on top of the 48.7 million workers who were laid off during the preceding fifteen weeks.

Here is a breakdown of each week:

• week ending on 21 March—3.31 million

• week ending on 28 March—6.87 million

• week ending on 4 April—6.62 million

• week ending on 11 April—5.24 million

• week ending on 18 April—4.44 million

• week ending on 25 April—3.87 million

• week ending on 2 May—3.18 million

• week ending on 9 May—2.69 million

• week ending on 16 May—2.45 million

• week ending on 23 May—2.12 million

• week ending on 30 May—1.90 million

• week ending on 6 June—1.57 million

• week ending on 13 June—1.54 million

• week ending on 20 June—1.48 million

• week ending on 27 June—1.41 million

• week ending on 4 July—1.31 million

All told, 50 million American workers have filed initial unemployment claims during the past sixteen weeks.

To put that into some kind of perspective, I produced a chart comparing the cumulative totals of the initial unemployment claims for the current pandemic compared to two other relevant periods: the worst point of the Second Great Depression (from the middle of January to early May 2009) and the weeks immediately preceding the current depression (from the end of November 2019 to mid-March 2020).

As readers can see in the chart above, the difference is stunning: 10.2 million workers filed initial claims during the worst 16-week period of 2009, 3.5 million from early December to mid-March of this year, and 50 million in the past sixteen weeks.

According to the most recent report from the Bureau of Labor Statistics, the number of unemployed workers actually fell by 3.2 million to 17.8 million in June, leading to an official unemployment rate of 11.1 percent—although, the surveys on which those data are based only capture those who were unemployed in mid-June, before the new wave of business shutdowns and layoffs.

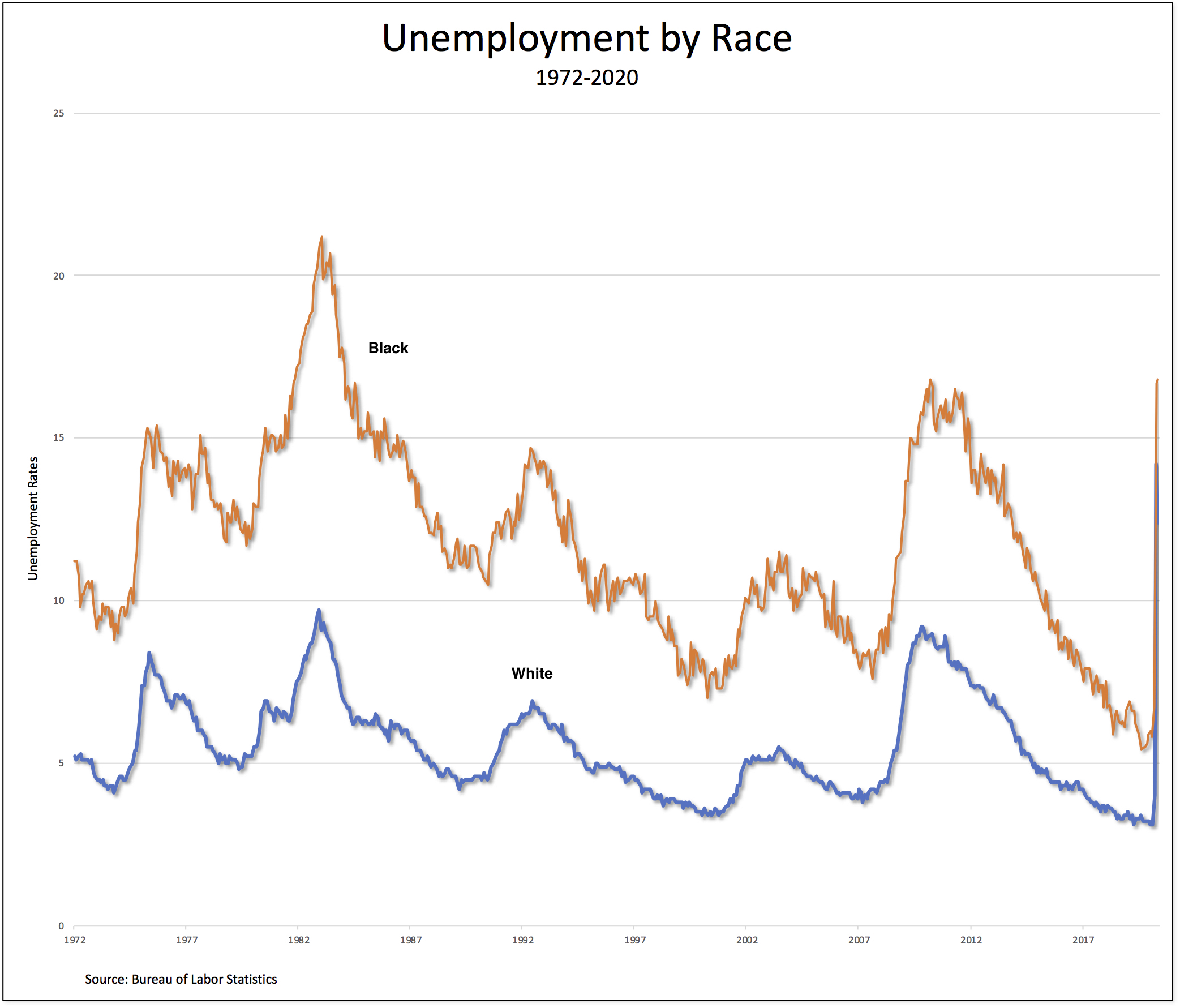

Moreover, even as the protests ignited a national uprising against racism in the aftermath of the police killing of George Floyd and others, African Americans have experienced the slowest recovery of all racial groups. While the official black unemployment rate in June fell (to 15.4 percent), it is still much higher than the white rate (10.1 percent) and higher even than the Hispanic rate (14.5 percent).

On top of that, we should add in the workers who are involuntarily working part-time jobs—in other words, workers who would like to have full-time jobs but have been forced “for economic reasons” to accept fewer hours—and discouraged workers—Americans who are able to work but have given up looking for a job. The reserve army of unemployed and underemployed workers then rises to something on the order of 30 million Americans.

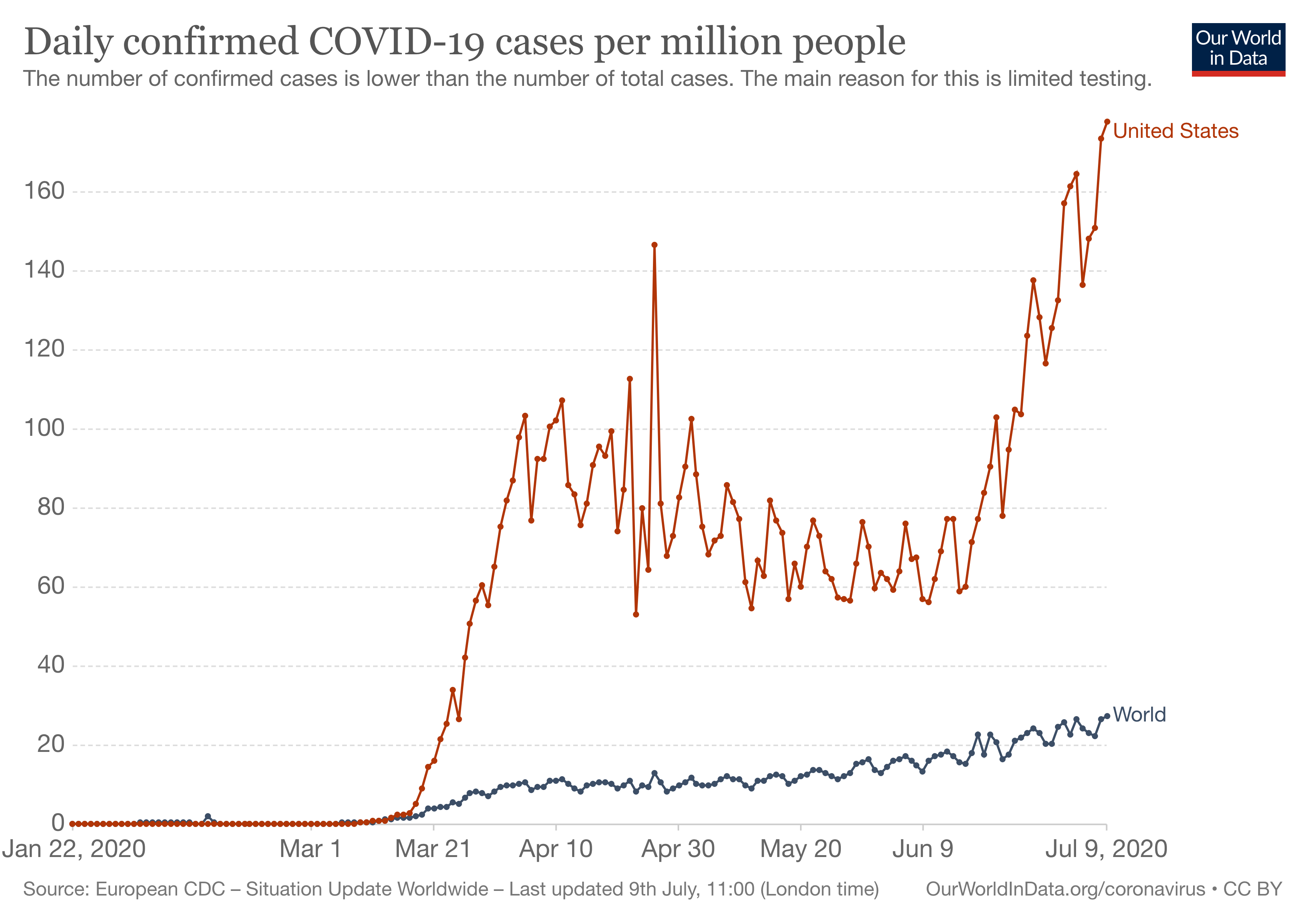

In the meantime, the United States continues to set daily records for new confirmed COVID-19 cases. Yesterday, there were 178 new cases per million people in the United States compared to 27.6 cases for the world as a whole.

We can therefore expect to see new waves of business closures, which in turn will mean more American workers furloughed and laid off, and therefore a steady stream of initial unemployment claims.

The only possible conclusion to draw is that, unless there’s a radical change in the U.S. response, the existing economic and social disaster in the United States will continue to worsen in the weeks and months ahead.

Black hunger matters

Posted: 9 July 2020 in UncategorizedTags: blacks, BLM, capitalism, children, food insecurity, Hispanics, households, hunger, racial capitalism, United States, whites

For those who remain skeptical, Black Lives Matter doesn’t mean that only Black lives matter. The movement represents the idea that, if Black lives don’t matter—because of police violence, COVID infections and deaths, unemployment, and much else—then all lives are diminished by the existing set of economic and social institutions.

Much the same holds for food insufficiency or hunger. If right now, in the midst of the pandemic, Black households are suffering more from a lack of food than Whites, then something is systemically wrong—American society is not treating all lives in a fair and humane manner.

It’s as if someone had a knee to their throats, not allowing them to eat.

But, of course, that’s not how racial capitalism works. There’s plenty of food to be had and no one is standing at the door of the grocery store or supermarket preventing them from entering. But people only get to eat a sufficient amount if they have the money to purchase the food. And if they lose their jobs or have their hours shortened or are faced with a pay cut, then their incomes aren’t enough to pay for the commodities they need, including food. They have to go without. So, if working-class Blacks (and Hispanics and others) are the last ones hired and the first hired, or they’re attempting to make do with whatever low-paying jobs are available, then they and their families go hungry.

So, what do the data show?

The chart at the top of the post shows how widespread and unequal hunger is in the United States. According to the information from the Census Bureau’s Household Pulse Surveys, comparing the situation from before the novel coronavirus pandemic (prior to 13 March 2020) and now (between 18 and 23 June 2020), overall food insufficiency has grown from an already-high 7.6 percent to 9.5 percent.* But the rates are much worse for Black Americans—both before the pandemic, when it was 16.5 percent, and more recently, when it has risen to 18.5 percent—as well as Hispanics—12.8 percent and 13.9 percent, respectively.

The situation is even more dire when we consider households with children, as indicated in the chart above. Overall, food insufficiency in such households has risen during the pandemic from 10.2 percent to 12.3 percent. But the rate for Blacks, which suffered from hunger at more than 3 times the rate of Whites before the pandemic, is now 20.5 percent. The rate for Hispanic households, which was already high, remains around 15 percent.**

Clearly, Black lives don’t matter in the United States when it comes to food sufficiency. They didn’t matter before the COVID crisis, and they matter even less now.

Transforming American society in the name of “liberty, justice, and freedom” means many things in this moment—including tackling the problem of hunger.

*In order to work with the questions in the Census Bureau survey, I define food insufficiency or hunger as the sum of responses of “sometimes not enough to eat” and “often not enough to eat.”

**If I include the third response, “enough food, but not always the types wanted”—and therefore add to the other answers the Census Bureau’s equivalent to the U.S. Department of Agriculture’s definition of low food security (“reports of reduced quality, variety, or desirability of diet. Little or no indication of reduced food intake”)—the rates soar. White households with children are experiencing a rate of food insecurity (as against hunger or food insufficiency, in the way I’ve used it in the text) of 40.5 percent. For Black households it’s 58 percent, and, in the case of Hispanic households, 58.8 percent.

The condition of the black working-class in the United States

Posted: 25 June 2020 in UncategorizedTags: blacks, civil rights, coronavirus, gender, Hispanics, inequality, labor force, Malcolm X, Martin Luther King Jr., men, pandemic, race, racism, unemployment, United States, wages, whites, women, working-class

Before he was killed, George Floyd worked as a truck, a bouncer, and a security guard. Ahmaud Arbery worked at his father’s car wash and landscaping business, and previously held a job at McDonald’s. Breonna Taylor was a certified Emergency Medical Technician who had two jobs at hospitals in Louisville, Kentucky. Eric Garner worked as a mechanic and then in New York City’s horticulture department for several years before health problems, including asthma, sleep apnea, and complications from diabetes, forced him to quit. Trayvon Martin was the son of a program coordinator for the Miami Dade Housing Authority and a truck driver; he washed cars, babysat, and cut grass to earn his own money.

All of them, and most of the other African Americans who have been killed in recent years (by the police or other Americans), were members of the black working-class in the United States.

The history of the black working-class begins, of course, with slavery and then continues—with almost-incessant violence, from slave patrols through lynchings to beatings and deaths at the hands of law enforcement and incarceration by the criminal justice system— through southern sharecropping, the Great Migration out of the rural South to the urban factories of the Northeast, Midwest, and West, and the panoply of jobs that currently exist in the public and private sectors of the United States.

For the purposes of this post, I want to focus on the most recent period—thus, from the end of the Great Migration, which roughly coincided with the assassinations of the two great Civil Rights leaders of the period, Malcolm X and Martin Luther King, Jr.

Even at the end of the Great Migration, more than half of the black working-class population remained in the South. But the region itself was changing, in large part because of the infrastructure associated with the spread of military bases and the subsequent industrialization of cities and towns in the non-cotton south—without however eliminating the anti-union, low-wage legacy of southern economies.

Meanwhile, in the North (both the Northeast and the Midwest), a large portion of black migrants managed to secure factory jobs. But the same migration channeled other black workers into the high-unemployment ghettos of northern cities, which if anything were worsening with the passage of time.

While in the first half of the twentieth century, labor unions had been anything but a positive force for black workers, by 1973 unionization rates among black men were over 40 percent, while rates among white men were between 30 and 40 percent.* And by the late 1970s, almost one quarter of black women—nearly double the share of white women—belonged to a union.

But, in 1972 (the first year for which data are available), the black unemployment rate was more than twice (2.15 times) that of white workers—which has persisted as an average, through the ups and downs of both unemployment rates, for the entire period down to the present.

What about workers’ wages? In 1973, average (median) real wages of black workers were only 78 percent of white wages—and, while the percentage has varied over the decades (reaching a high of 84 percent in 1979, no doubt due to the influence of labor unions), by 2019 the percentage had fallen even lower, to 76 percent.

The wages of the black working-class (just like those of the white working-class) exhibited a clear hierarchy based on gender in the early 1970s. Black women earned on average 69 percent of what black men did (while white women’s wages were even less, about 62 percent of their male counterparts). But then some of the gaps began to decrease: between black women and men (as well as between white women and men). In fact, by 2019, black working-class women’s wages were 94 percent of those of black men (although, by then, white women’s wages were higher than both black men and women). But the wage gap between black and white men had actually grown—from 24.5 percent (in 1973) to 31.7 percent (in 2019).

The gender composition of the black working-class both reflected and contributed to the changes in wage gaps over the past five decades. In 1972, the labor force participation rate of black men was much higher than that of black women: 78.5 percent compared to 51.1 percent. But the gap between the two rates has declined dramatically over time, both because the rate for men has fallen (largely due to the increased incarceration rate of black men) and the increase in the rate for women (as they became increasingly engaged in employment outside the household). So, even though both rates have fallen in recent decades (mirroring the nationwide decline in the labor force participation rate, the gray line in the chart), the changes between 1972 and 2019 for both groups are striking: the rate for black men had declined to 68.1 percent while that of black women had increased to 62.5 percent.

The result is that black women, who in 1972 made up 44.9 percent of the black civilian labor force, now comprise 52.5 percent. The share of black men has thus declined—from 55.12 percent to 47.5 percent.

While the victories of the Civil Rights Movement in dismantling Jim (and Jane) Crow laws were appropriately celebrated, the movement never succeeded in eliminating systemic or structural racism—from employment and housing discrimination through health disparities to the racial biases of the prison-industrial complex. Moreover, the initial progress in narrowing the wage gaps within the working-class coincided with a new assault on American workers and the dramatic growth in inequality in the U.S. economy as a whole. Racial capitalism in the United States therefore changed beginning in the late-1970s, leaving the American working-class—and, even more so, black (and Hispanic) workers—further and further behind the tiny group at the top.

By 2020, the increasing precarity of the black working-class made its members more exposed to physical attacks and police murders, the ravages of the novel coronavirus pandemic, and the negative effects of the economic crisis.

Last year, 24 percent of all police killings were of black Americans when just 13 percent of the U.S. population is black—an 11-point discrepancy. Mapping Police Violence also showed that 99 percent of all officers involved in all police killings were never charged.

The latest overall COVID-19 mortality rate for black Americans (compiled by the the APM Research Lab) is 2.3 times as high as the rate for whites, and they’re dying above their population share in 30 states and, most dramatically, in Washington, D.C.

Even as the rate of layoffs has largely slowed over the past two months, black job losses rose in May and June relative to those of white workers. In fact, according to the New York Times,

For long stretches of the pandemic, black and white employment losses largely mirrored each other. But in the last month, layoffs among African-Americans have grown while white employment has risen slightly. Now, among all the black workers who were employed before the pandemic, one in six are no longer working.

And all indications are that the economic recovery, if and when there is one, will be both long and painful, especially for the African American working-class.

It has become increasingly clear, especially in recent weeks as a national uprising has responded to the deaths of Floyd and many other members of the black working-class at the hands of the police, that these incidents did not happen in isolation. It is therefore time for the American working-class—black, brown, and white—to overcome its divisions and confront the problem of racism head-on. That’s certainly how the Executive Board of the Communication Workers of America sees things:

The only pathway to a just society for all is deep, structural change. Justice for Black people is inextricably linked to justice for all working people – including White people. The bosses, the rich, and the corporate executives have known this fact and have used race as one of the most effective and destructive ways to divide workers. Unions have a duty to fight for power, dignity and the right to live for every working-class person in every place. Our fight and the issues we care about do not stop when workers punch out for the day and leave the garage, call center, office, or plant. . .

Thoughts and prayers aren’t enough. No amount of statements and press releases will bring back the lives lost and remedy the suffering our communities have to bear. We must move to action.

*According to Natalie Spievack,

In 1935, when the National Labor Relations Act gave workers the legal right to engage in collective bargaining, less than 1 percent of all union workers were black. Union formation excluded agricultural and domestic workers, occupations predominantly held by black workers, and largely left black workers unable to organize.

By the late 1960s and early 1970s, unions began to integrate. The manufacturing boom brought large numbers of black workers north to factories, the civil rights movement focused increasingly on economic issues, and the more liberal Congress of Industrial Organizations organized black workers.

Freedom—pandemic edition

Posted: 18 June 2020 in UncategorizedTags: blacks, BLM, Boeing, coronavirus, deaths, economy, freedom, inequality, pandemic, police, R.G.D. Kelley, race, racism, Slavoj Žižek, stock market, stocks, unemployment, United States, violence, whites, workers

“Formal” freedom is the freedom of choice WITHIN the coordinates of the existing power relations, while “actual” freedom designates the site of an intervention which undermines these very coordinates.

— Slavoj Žižek, On Belief

The novel coronavirus pandemic has demonstrated how shallow and restricted the notion of formal freedom is in the United States.

After years of pretending that private healthcare and health insurance expanded the freedom of individual choice, even with the changes introduced by Obamacare, the existing health system has failed to protect most Americans from the ravages of the disease. Right now, with over 2 million confirmed cases and over 100 thousand deaths, the United States has over one quarter of the world’s cases and fatalities. And the numbers continue to rise in many states, with the forced reopening of businesses.

Yes, in recent years, Americans have been able to choose to work at a job and use their employer-provided health benefits or to purchase health insurance on state exchanges, thereby dramatically lowering the number of uninsured people. But they haven’t been able to choose what kind of health system they want, how they want their healthcare to be provided. As a result, the existing—understaffed and underfunded—public health system, in the midst of an obscenely unequal economy and society, has been unable to effectively confront the spread of COVID-19.

It’s that same formal freedom that allows investors to purchase stocks, including equity shares in Hertz, which just happens to have entered bankruptcy protection in late May. Between the 3 and 8 June, Hertz’s stock exploded in price. During that week, it increased to $5.53 per share, from 82 cents, a preposterous rise of nearly seven times—apparently just one example of a more general “flight to crap” in U.S. stock markets. And just to highlight the absurdity of what freedom means in the United States, the nation’s second-largest car-rental agency filed with the Securities and Exchange commission to sell up to $500 million worth of new shares—shares that would likely be rendered worthless after creditors are paid off—in a move that was approved by the federal judge in Delaware overseeing the Hertz bankruptcy case. (And then, just yesterday, Hertz reversed course and decided to pull the plug on the deal.)

And it’s the freedom aircraft manufacturer Boeing relied on in late April to raise $25 billion by selling bonds to investors, to avoid taking aid from the federal government, and then a month later to fire 6,770 workers (part of its plan to reduce a total of 16 thousand jobs).

Meanwhile, employers and the White House (including Labor Secretary Eugene Scalia) are clamoring for businesses to be allowed the freedom to reopen. But they’re worried unemployed workers, who have received supplemental benefits as a result of the CARES act, will not want to return to work under with the risk of becoming infected with the virus. So, they’ve announced both that the extra $600 “disincentive” for people to return to work will be allowed to expire at the end of July and that any workers who refuse to be called back to work will lose their unemployment payments.

Clearly, employers’ freedom to reopen their businesses is coming at the expense of workers’ freedom to stay home during the pandemic. And that’s the limit of formal freedom under capitalism—the kind of fundamental clash during which it is possible to begin to exercise an actual freedom of reimagining and reinventing the rules of economic and social organization.

Thus far, however, we haven’t seen much in the way of actual freedom in the economic sphere. Massive unemployment, and therefore the unremitting pressure on all workers, both those with jobs and those without, will do that. But we might just be witnessing such a site in the other fundamental clash currently taking place, the one that arose in response to the recent murders of George Floyd, Ahmaud Arbery, and Breonna Taylor.

The first demand of the Black Lives Matter movement is, of course, freedom from police violence. It’s a freedom enumerated in the Constitution (in the Fourteenth Amendment) but undermined and subverted by the systemic racism that historically and still today has haunted the administration of justice in the United States—by both the police and the courts.

The pandemic has also highlighted—and further exacerbated—the obscene racial inequalities that characterize the American economy and society. For example, black Americans are dying from Covid-19 at three times the rate of white people. And while unemployment has skyrocketed for black and white workers in the COVID-19 labor market, the unemployment rate is much higher for black workers, which has in turn worsened the already-high income and benefits gaps between white and black workers.

As it turns out, the Black Lives Matter movement was already, back in 2016, thinking beyond police violence. As Robin G. D. Kelley explained, the organization is invested in a structural overhaul of the American system that oppresses most people. Its demands therefore include

ending all forms of violence and injustice endured by black people; redirecting resources from prisons and the military to education, health, and safety; creating a just, democratically controlled economy; and securing black political power within a genuinely inclusive democracy.

That’s more than a laundry list of demands or a simple political platform (like those of the Democratic and Republican parties). It’s a vision of economic and social transformation that will produce deep structural changes—for black communities and for all Americans. In other words, it aspires to an enactment of actual freedom that questions the existing coordinates of power relations in the United States (and around the world).

The Black Lives Matter movement infuses the current protests—indeed, the multiracial national uprising we’re witnessing across the country—with the potential of becoming the most recent in the tradition of real progressive social movements which, as Kelley explained in his 2002 book Freedom Dreams: The Black Radical Imagination,

do not simply produce statistics and narratives of oppression; rather, the best ones do what great poetry always does: transport us to another place, compel us to imagine a new society.

It’s only a possibility, at this stage—the potential of moving beyond a formal freedom from fear to an actual freedom of redrawing the existing boundaries of the economy and society, by generating radically new questions, theories, and knowledges. It’s a freedom that can only be produced by a combination of ruthless critical thinking and collective political activity.

It’s a freedom that allows us—indeed, compels us—to imagine a new society.

Cartoon of the day

Posted: 18 June 2020 in UncategorizedTags: banks, blacks, cartoon, human rights, looting, police, racism, slavery, United States, violence

Cartoon of the day

Posted: 17 June 2020 in UncategorizedTags: blacks, cartoon, colonialism, inequality, police, racism, schools, violence, whites

Cartoon of the day

Posted: 6 June 2020 in UncategorizedTags: blacks, cartoon, CEOs, corporations, protests, religion, rights, Trump, violence

Cartoon of the day

Posted: 5 June 2020 in UncategorizedTags: blacks, cartoon, coronavirus, pandemic, police, racism, Trump, United States, violence, Wall Street